Why you should use specialist medical accountants in your medical practice (updated for 2024)

- Published in Business, Walshs Blog

The path to homeownership: Your first home buyer FAQ’s answered

- Published in Uncategorized, Walshs Blog

Preparing for a move into private practice

- Published in Walshs Blog

Offsetting your Offset: The power of compounding interest

- Published in Walshs Blog

Navigating the best home loans for doctors – updated for 2024

- Published in Walshs Blog

DO I need a bookkeeper?

- Published in Walshs Blog

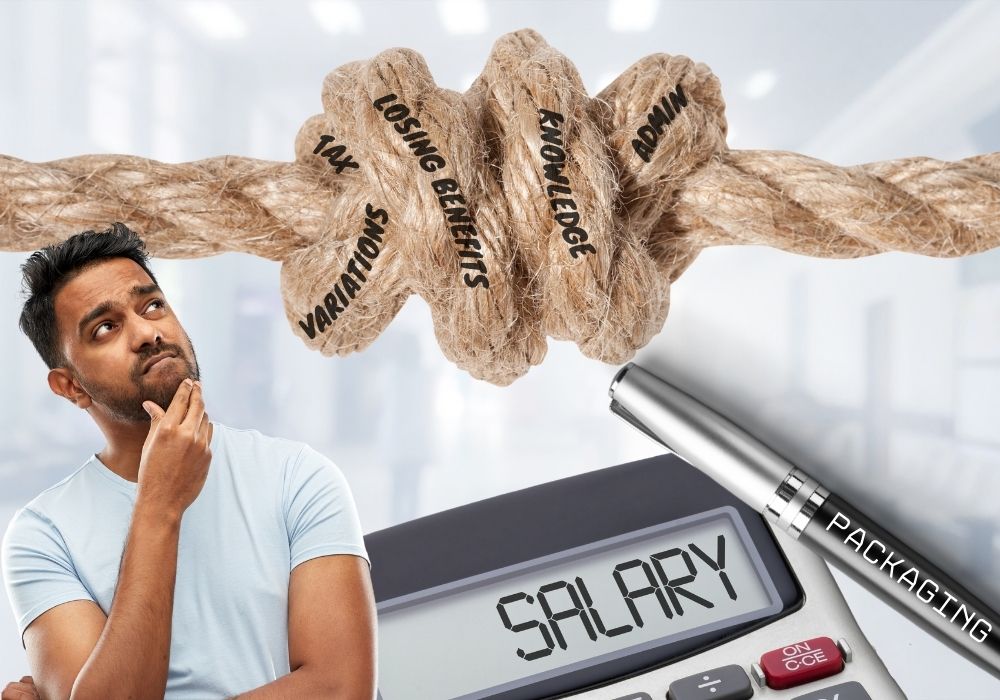

Navigating salary packaging changes for Queensland medical staff

- Published in Uncategorized

Here is why working with Walshs is a great decision

- Published in Walshs Blog

Cost of living boost!

- Published in Walshs Blog

Build to Rent – What’s the Big Deal?

- Published in Walshs Blog

Why the home loan with the cheapest rate might not be the best loan for you

- Published in Walshs Blog

The pros and cons of long and short term investment property rental arrangements

- Published in Walshs Blog