- 1

- 2

Walshs is delighted to announce that the Bongiorno National Network (BNN) has officially become an Alliance Partner of the Australian Orthopaedic Association (AOA). This exciting national partnership brings together Australia’s largest network of financial specialists for medical professionals with the country’s leading organisation representing orthopaedic surgeons, trainees, and researchers. A trusted partner for surgeons across

Walshs has strengthened ties with the Australian Orthopaedic Association (AOA) Queensland Branch as a Regional Alliance Partner. This collaboration reflects our shared commitment to supporting Queensland’s orthopaedic surgeons, trainees, and medical researchers by providing access to specialist financial advice, education, and resources tailored to the needs of medical professionals. For over 30 years, Walshs has

When running a business, creating a positive and engaging environment for your employees is key to success. Whether you’re throwing a Christmas party, organising a recreation day, or hosting a seminar, these events can boost morale and strengthen your team. However, it’s essential to understand how Fringe Benefits Tax (FBT) applies to these activities. Understanding

Economic Outlook The economic outlook was once again presented by the Chief Economist for KPMG Australia – Dr Brendan Rynne. In 2023, he was one of the 20% of Australian economists that believed there would be no recession in the technical terms (two consecutive quarters of negative growth in real GDP), but he advised that

Becoming a homeowner is a significant milestone that often begins with a myriad of questions, uncertainties, and excitement. For first home buyers, understanding the intricacies of the property market and navigating the mortgage landscape can be a daunting task. That’s where a mortgage broker becomes an invaluable ally, guiding prospective buyers through the complex process

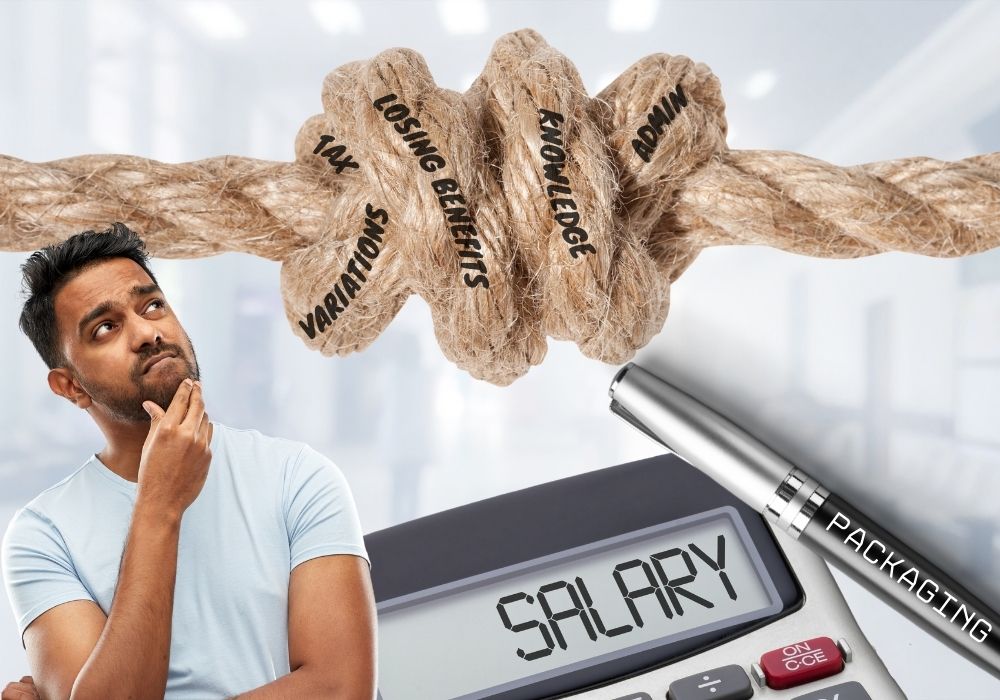

Salary Packaging is a remuneration arrangement that allows employees to receive a Fringe Tax Benefit by reducing their taxable income. There are significant financial advantages provided to employees who fall into the category of eligible participants, a group which includes many medical professionals. BUT navigating this process can be complex and certainly when moving between

Structuring your home loan to get the best possible tax outcomes as a doctor is vital, considering the huge amounts you send to the tax man every year. At Walshs, we are specialists in not only securing market-leading home loans for doctors but in supporting your future wealth health. As such, we’ve created this handy

Self-Managed Superannuation Funds (SMSFs) have become a popular investment vehicle in Australia, offering individuals greater control over their retirement savings. One intriguing avenue for SMSF investment is purchasing medical rooms. Not only does this provide a stable income stream, but it also allows healthcare professionals to secure their own practice premises. In this blog, we

If you’re a student doctor, chances are your first home buy won’t be your last. As one of Australia’s leading medical mortgage specialists, we know your first house isn’t likely to be your “forever home” – in reality it’ll probably be the first in a string of real estate cash cows. And wealth health, my

As 30 June 2021 fast approaches it is important to ensure the tax planning and compliance issues relating to your self-managed superannuation fund are in order. Set out below are a few matters to consider and take action on where necessary. Contributions The maximum contribution levels for 2020-21 for concessional and non-concessional contributions are: Concessional