How Outsourcing Medical Accounting Services Can Be a Game Changer for Your Medical Practice

- Published in Articles, Walshs Blog

Safeguarding patient data: Essential cyber security strategies for medical professionals

- Published in Walshs Blog

Stamp Duty Changes: A Guide for First Home Buyers

- Published in Walshs Blog

Should I make a claim and what to do: A guide for medical professionals

- Published in Walshs Blog

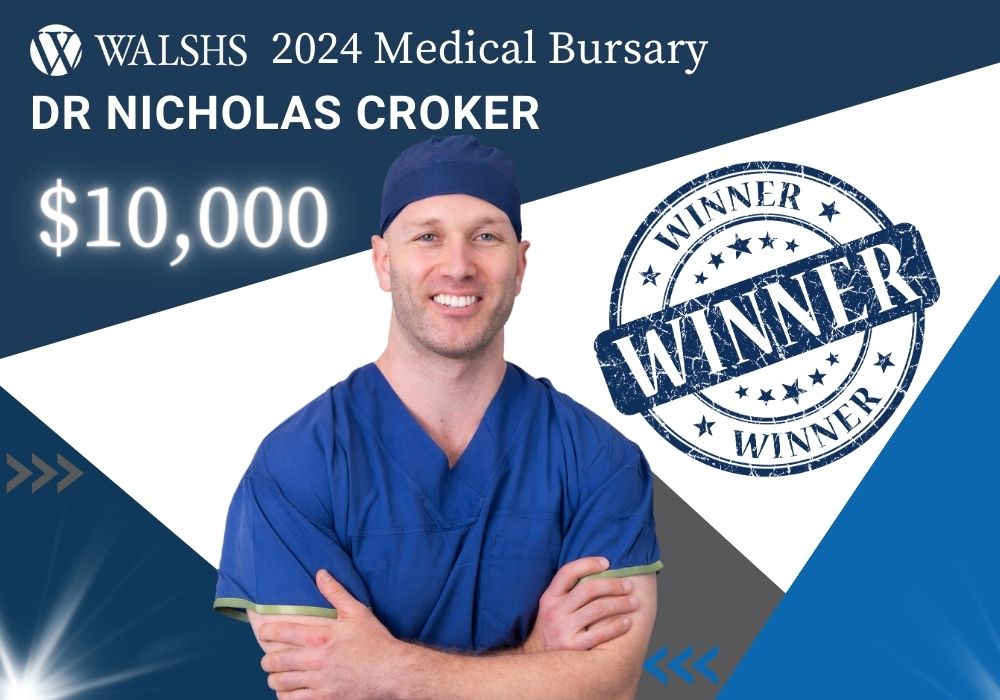

The winner of the 2024 $10,000 Walshs Medical Bursary is Dr Nicholas Croker!

- Published in Walshs Blog

Medical Accounting – your FAQs answered

- Published in Articles, Business, Walshs Blog

Key Budget takeaways for individuals, business and superannuation

- Published in Walshs Blog

A quick guide to depreciating assets

- Published in Walshs Blog

Home Loans for Doctors – your FAQs answered

- Published in Articles, Business, Walshs Blog

A tax planning meeting is important and here’s why…

- Published in Walshs Blog

Are you a junior doctor thinking about buying your first home?

- Published in Walshs Blog

The scoop on Queensland property & economic outlook for 2024

- Published in Uncategorized