In the ever-evolving world of personal finance, making informed decisions about where to invest your hard-earned money is crucial. While traditional wisdom often advocates for paying down mortgages, there are times when embracing the potential of the stock market might be a more advantageous strategy. This blog post aims to explore why, especially in the context of near-peak cash rates and the potential for rate cuts, investing in stocks could outshine the benefits of offsetting a mortgage over a long period of time.

As we stand on the precipice of potential rate cuts, the conventional belief is that lowering interest rates could lead to increased borrowing and stimulate economic growth. However, from an investment perspective, this can also signal positive trends in the equity market, as lower costs of capital and renewed consumer strength potentially boost corporate earnings.

One of the key distinctions between investing in stocks and offsetting a mortgage lies in the nature of returns. Mortgage offset accounts offer a linear return – reducing the interest paid on your mortgage and thereby decreasing your debt repayments. On the other hand, investing in stocks opens the door to compounding returns, a powerful force that has the potential to generate exponential growth over time.

So, what does this look like?

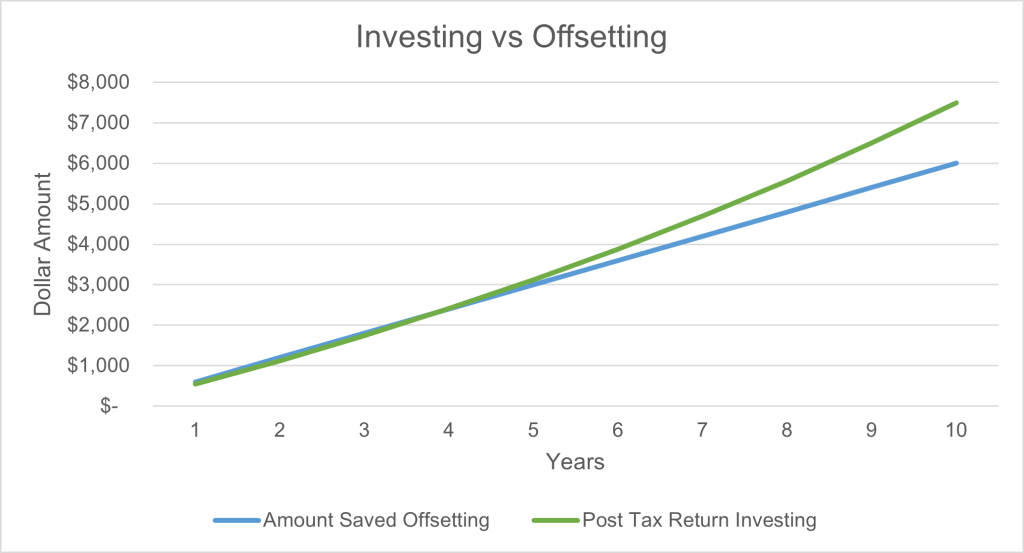

Let’s consider a scenario where you have an extra $10,000 to allocate. In a mortgage offset account, the benefits are straightforward – the interest saved on your mortgage payments. Assuming an interest rate of 6% over a ten-year period, the total amount saved on your mortgage would amount to $6,000 – or $600 per year.

On the other hand, were this $10,000 to be invested to a diversified portfolio, assuming a modest annual return of 7%, after the same period of time the initial $10,000 investment could grow to approximately $19,672.

For the sake of a fair comparison, the post-tax returns have been calculated on the investment portfolio, assuming a 50% CGT discount and that the investment sits within the top marginal tax bracket. The after-tax return amounts to $7,495.

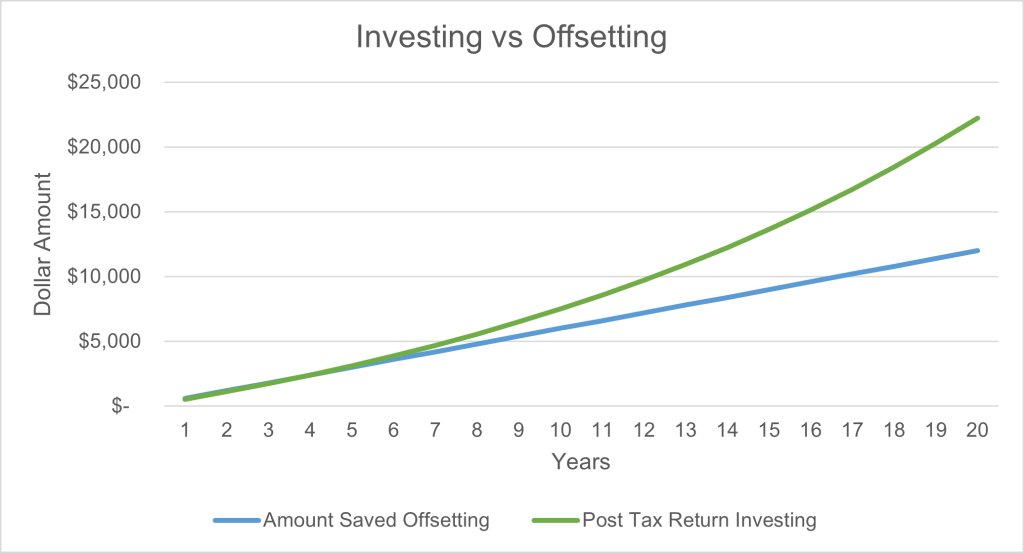

This may not seem like much at first glance, but compounding returns work best when left for long periods of time. For instance, if this initial $10,000 was left for 20 years instead of 10 years, the total after-tax return grows to $22,240:

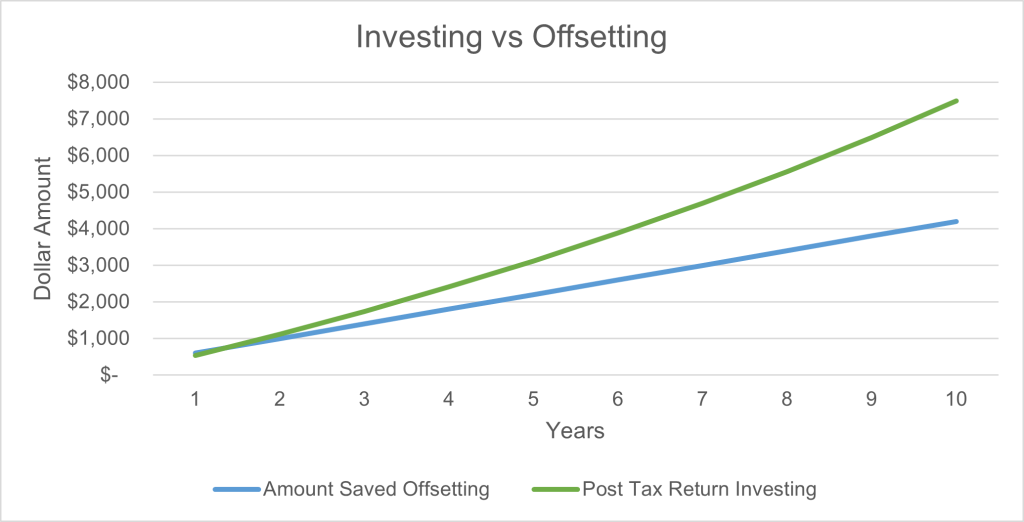

So, what happens when rate cuts are factored in? Assuming that, after the first year, mortgage rates drop from 6% to 4% and remain there for the remaining 9 years. In total, the amount saved when offsetting in this instance is $4,200 – a fair difference to the invested after-tax returns.

In the examples shown above, investing in stocks can potentially yield much higher returns over a period of time. Whilst these examples have been simplified for the purpose of this blog, please note that they do not account for market fluctuations or timing, they simply underscore the fundamental difference between compounding investment returns and linear offset savings.

While investing in stocks involves inherent risks, a well-diversified portfolio can help mitigate these risks. The potential for higher returns comes with the understanding that the market can be volatile. By carefully selecting a mix of stocks across sectors, you can create a balanced portfolio that aligns with your risk tolerance and financial goals. Another factor is market timing risk, which you can alleviate through dollar-cost-averaging. (See my blog on the topic of ‘dollar-cost-averaging’ HERE).

In the current financial landscape, where cash rates may be peaking and rate cuts could be on the horizon, investors should carefully evaluate their options. While paying down a mortgage is a prudent financial strategy, and easy to consider when cash and mortgage rates are high, the potential for long-term, compounding stock market returns should not be ignored.

I hope that this blog has helped you better understand the dynamics of compounding returns, and we encourage you to speak to a member of our Walshs advice or investments team to discuss these points with consideration to your personal circumstances.

It’s important to note that individual circumstances, risk tolerance, and market conditions should be considered before making financial decisions, and that this blog should not be considered as financial advice.

Article by Tim McAllister, Walshs Investment Analyst