As an investment property owner, keeping up with your tax obligations can feel overwhelming — especially with recent changes to the ATO’s property management data-matching protocol. The ATO is now receiving more detailed information about your rental property, including rental income and expenses. With data coming from software providers, banks, rental bond authorities, and even sharing economy platforms, it’s easier than ever for common mistakes to be flagged.

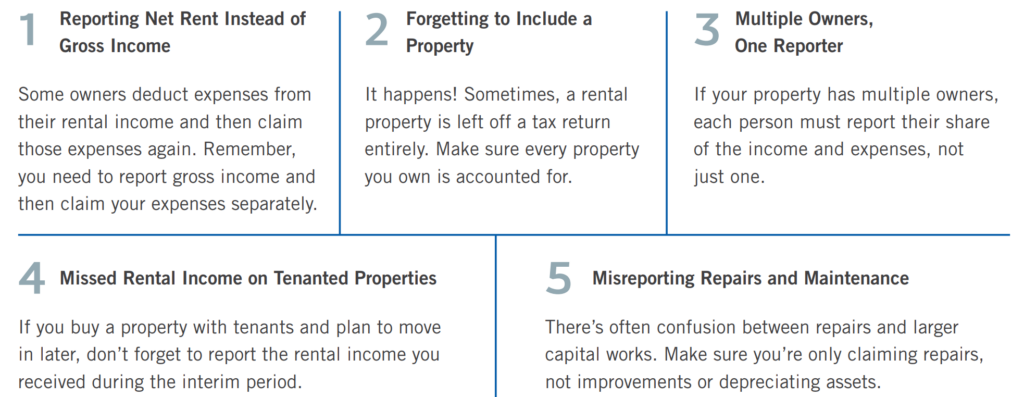

Common mistakes that could land you in trouble

The ATO has identified several frequent errors made by property owners. Some of the most common include:

In addition to these common mistakes, it’s crucial to take proactive steps to ensure full compliance with tax regulations. This includes:

- Accurately declaring all rental income—including earnings from short-term rental platforms like Airbnb

- Correctly apportioning loan interest between private and investment use

- Maintaining proper records to support your claims and deductions

- Ensuring precise calculations of capital gains tax (CGT) liabilities when selling a rental property

With the ATO using sophisticated data-matching techniques, even small errors could trigger an audit or penalties so, staying on top of your obligations is more important than ever.

Stay Ahead of the ATO

The ATO’s enhanced data-matching isn’t just about identifying errors, it’s also about ensuring property owners have the right information to meet their tax obligations confidently. By staying informed and proactive, you can avoid unnecessary scrutiny while making the most of your eligible deductions.

If you’re unsure about any aspect of your rental property tax obligations, we’re here to help. Whether it’s reviewing past returns, clarifying deductions, or ensuring compliance with recent tax changes, our expert team at Walshs can guide you through the process.

Book a meeting HERE to get tailored advice.