How to minimise your risk and exposure to payroll tax

- Published in Walshs Blog

Income protection policy changes are on the way

- Published in Walshs Blog

How businesses can benefit from JobMaker incentives

- Published in Articles, Business, Walshs Blog

What the Federal Budget means for you

- Published in Articles, Walshs Blog

What the Federal Government’s extended JobKeeper Scheme means for you

- Published in Articles, Business, Walshs Blog

COVID-19 dominated the 2019/20 financial year

- Published in Articles, Business, Walshs Blog

What happens if your SMSF becomes non-compliant?

- Published in Articles, Walshs Blog

Deadline for amnesty on late Superannuation Guarantee payments

- Published in Articles, Walshs Blog

The Government’s latest COVID-19 initiatives explained

- Published in Uncategorized, Walshs Blog

What the JobKeeper Payment changes mean to your business

- Published in Articles, Walshs Blog

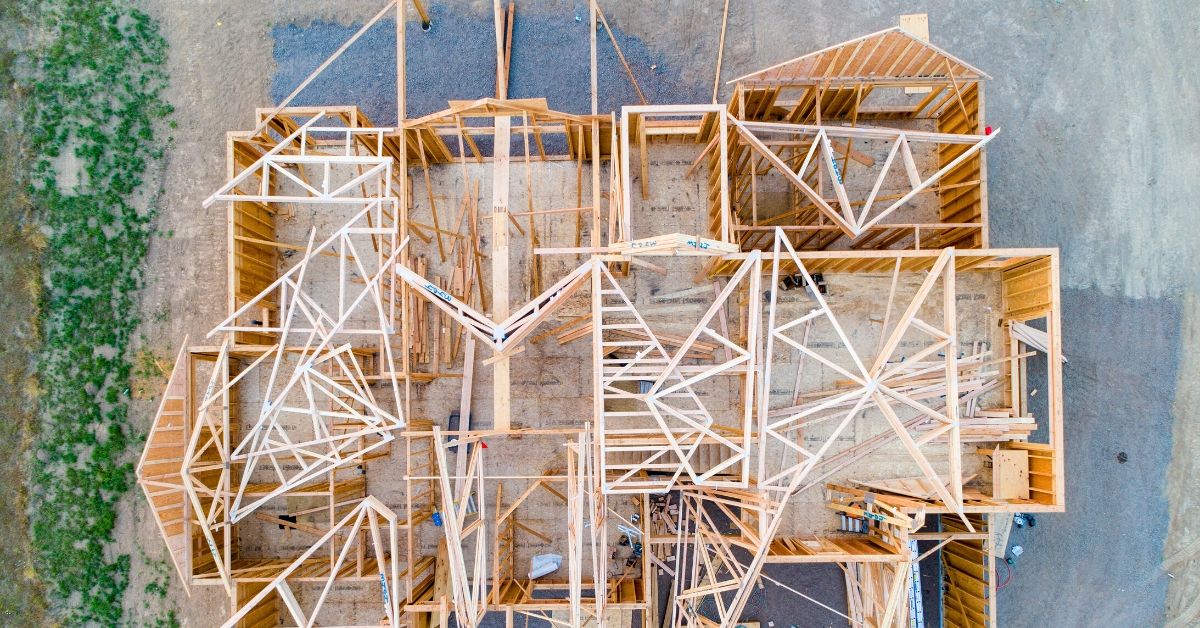

HomeBuilder program is a welcome boost to the economy but not everyone will be eligible

- Published in Articles, Uncategorized, Walshs Blog