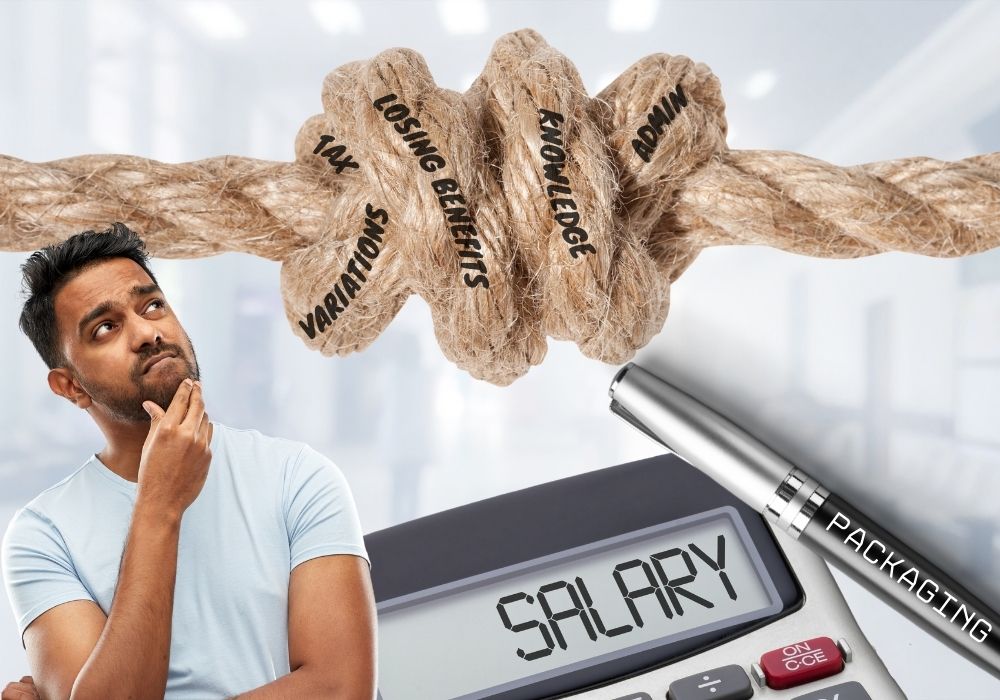

Salary Packaging is a remuneration arrangement that allows employees to receive a Fringe Tax Benefit by reducing their taxable income. There are significant financial advantages provided to employees who fall into the category of eligible participants, a group which includes many medical professionals. BUT navigating this process can be complex and certainly when moving between

We are delighted to share the news that the Walshs team has experienced great success throughout the year, securing #60 in the Australian Financial Review Top 100 Accounting Firms and as finalists within several categories at the Australian Accounting Awards 2023 and the IFA Excellence Awards 2023. These awards recognise outstanding contributions within the financial

The Queensland government has recently implemented a significant boost to its First Home Owner Grant, branding it as a “cost of living boost” for aspiring homeowners. This initiative sees a substantial increase in the grant from $15,000 to $30,000, a move anticipated to benefit approximately 12,000 first-time home buyers before the offer expires in June

By now you would have heard about the asset class Build to Rent (BTR), which is a relative newcomer to the Queensland market. What does it entail, what are the benefits, and, of course what are some of the current tax considerations relevant for developers. What is it and what are the benefits? In Australia,

When it comes to securing a home loan, many prospective homeowners are understandably drawn to the idea of finding the cheapest interest rate possible. After all, who wouldn’t want to pay less in interest over the life of their loan? However, it’s essential to recognise that the cheapest home loan rate might not always be

Investing in property as an asset class is an excellent method to create meaningful long-term wealth through leveraged returns and passive income. There are generally two types of investment property rental options, short-term or long-term rental agreements. Each have their own pros and cons which we’ve outlined below. Long-term rental investments Long-term rental investments involve leasing

Despite this month’s rate respite, borrowers are feeling the pain. Walshs Finance’s Donna Sutherland outlines one simple way to get ahead. August 2023 is the first month that borrowers will feel the full impact of 12 cash rate rises since May last year because lenders can take a few months to pass on the full

Self-Managed Superannuation Funds (SMSFs) have become a popular investment vehicle in Australia, offering individuals greater control over their retirement savings. One intriguing avenue for SMSF investment is purchasing medical rooms. Not only does this provide a stable income stream, but it also allows healthcare professionals to secure their own practice premises. In this blog, we

When Rob, an anaesthetics registrar, was diagnosed with Melanoma, many things were going through his mind – his long-term health, his family, the exams he had coming up, but one thing he didn’t have to worry about was his income. “I’m a doctor so I see people every day who are sick or injured. While