We know how busy you are

Walshs exists to make your life easier by providing the right advice and expert services.

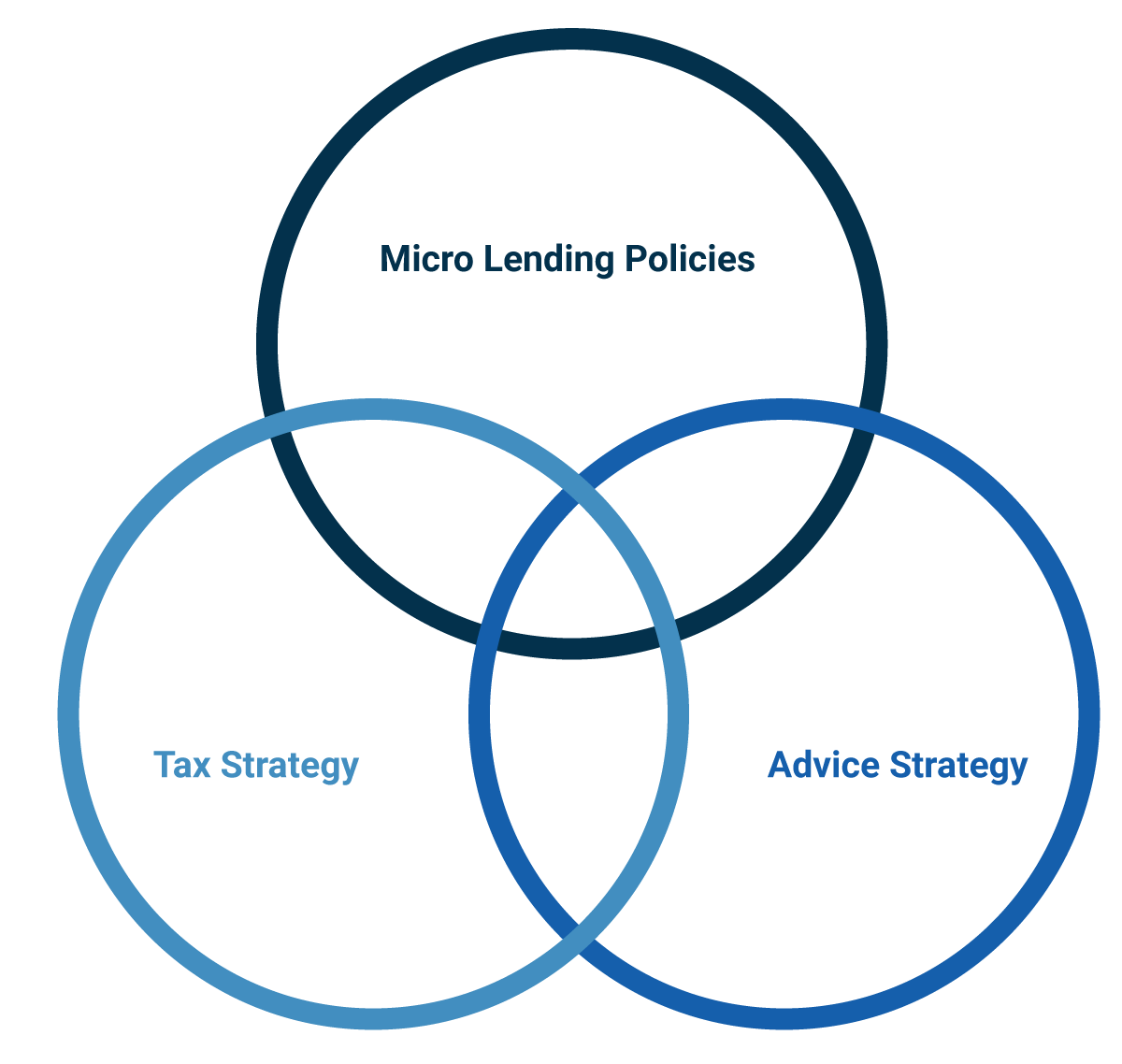

We know how time-consuming it is to organise your tax returns, manage your financial affairs, organise home loans, or research where to allocate your capital. We make your life easier by seamlessly taking care of your finances across all of our divisions.

Our stress-free approach to financial management extends to your meetings with us. Our advisers regularly travel to regional centres throughout Queensland to make it easy to do business with us. We can accommodate your demanding schedule by coming to you or meeting virtually. Plus we regularly meet outside normal business hours to work around your practice hours or shift work.

If you have any questions about how we can get the financial side of your life organised, book a complimentary meeting at a time that suits you.