- 1

- 2

As 30 June 2021 fast approaches it is important to ensure the tax planning and compliance issues relating to your self-managed superannuation fund are in order. Set out below are a few matters to consider and take action on where necessary. Contributions The maximum contribution levels for 2020-21 for concessional and non-concessional contributions are: Concessional

The announcement of the Federal Budget delivered on Tuesday night may have left you considering what the main outcomes and implications are to you and your business. The team at Walshs have put together a summary of the key considerations and take-aways from Tuesday’s Federal Budget announcement for you below. As always, we are here

By Michael Walsh, CEO Walshs The Federal Treasurer has announced a significant deficit of $85.8 billion for 2019-2020 and an estimated $184.5 billion deficit for 2020-2021, so Australians (especially businesses) are facing some challenging headwinds over the next few years. We are here to assist with cashflow forecasting and budgeting, applying for loans and grants, managing tax

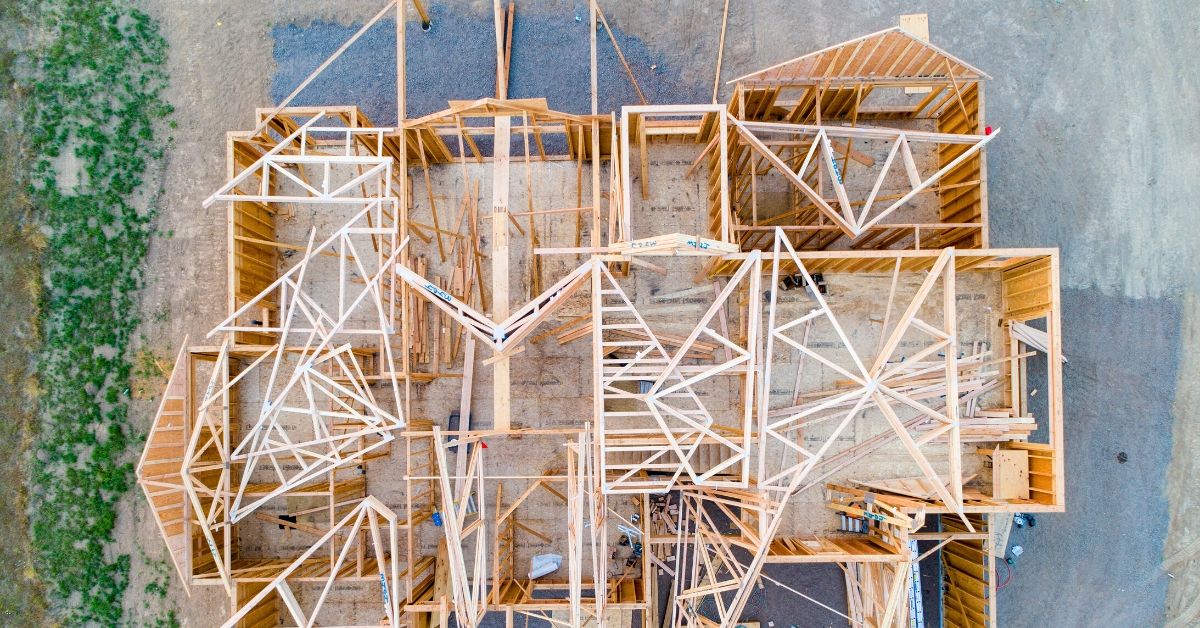

By Peter Hodgson, Financial Advisor at Walshs The Federal Government’s new HomeBuilder program is great news for Australia’s building industry, as well as people wanting to improve their homes. But it comes with strict criteria. Prime Minister Scott Morrison unveiled the program, which will give eligible Australians $25,000 to build or substantially renovate their homes,

A binding death benefit nomination (BDBN) is a written notice provided to the trustee of a super fund which explicitly nominates a beneficiary for the super benefit in the case of the fund owners death. Individuals can choose to nominate either a dependent or a legal personal representative to receive the contents of their super

[vc_row type=”in_container” full_screen_row_position=”middle” scene_position=”center” text_color=”dark” text_align=”left” overlay_strength=”0.3″][vc_column column_padding=”no-extra-padding” column_padding_position=”all” background_color_opacity=”1″ background_hover_color_opacity=”1″ width=”1/1″ tablet_text_alignment=”default” phone_text_alignment=”default”][vc_column_text] Benefits of using a testamentary trust Testamentary trusts are established under a valid will to provide a greater level of control over the distribution of assets to beneficiaries. Not only do testamentary trusts provide tax advantages, they can also be an

[vc_row type=”in_container” full_screen_row_position=”middle” scene_position=”center” text_color=”dark” text_align=”left” overlay_strength=”0.3″][vc_column column_padding=”no-extra-padding” column_padding_position=”all” background_color_opacity=”1″ background_hover_color_opacity=”1″ width=”1/1″ tablet_text_alignment=”default” phone_text_alignment=”default”][vc_column_text]Income Tax Return Checklist 2019[/vc_column_text][/vc_column][/vc_row]