By Peter Hodgson, Financial Advisor at Walshs

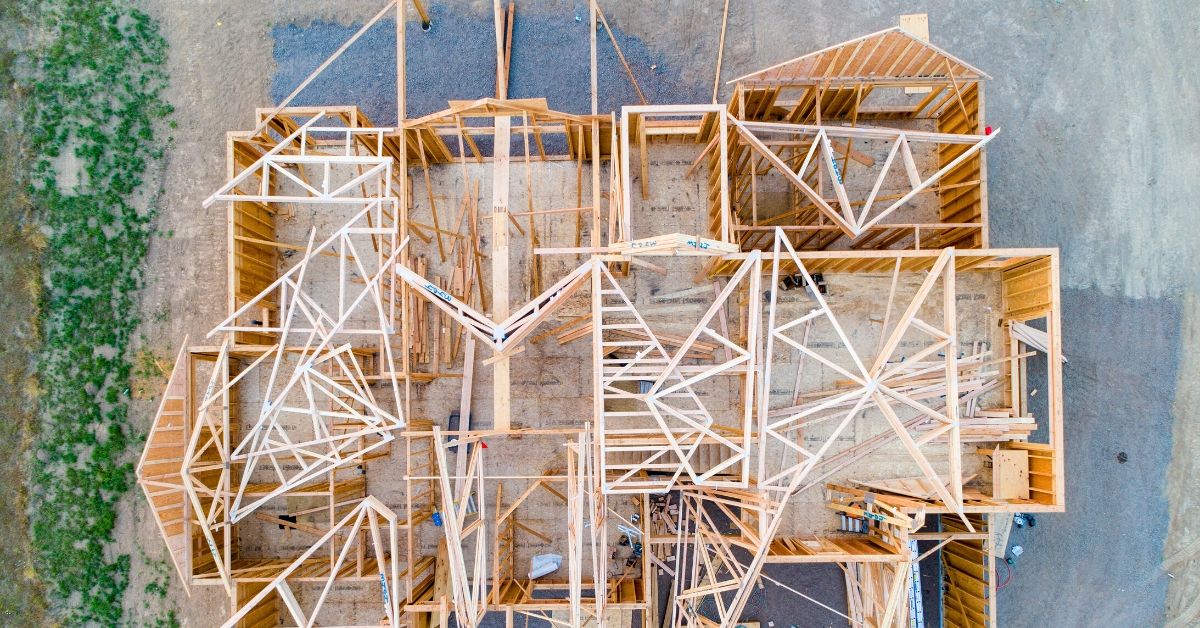

The Federal Government’s new HomeBuilder program is great news for Australia’s building industry, as well as people wanting to improve their homes.

But it comes with strict criteria.

Prime Minister Scott Morrison unveiled the program, which will give eligible Australians $25,000 to build or substantially renovate their homes, in an effort to boost demand in the construction sector and keep builders employed.

Master Builders Australia says that, based on the Government’s estimated 27,000 grants, it believes the program will be used for $10 billion in building activity, supporting the viability of 368,000 small builders and tradies which employ 800,000 people.

But not every home owner will be eligible to receive $25,000 to renovate their home or boost their budget to build a new home.

To qualify for HomeBuilder funds to renovate an existing property it needs to have been previously valued at less than $1.5 million and the total value of the renovations must be between $150,000 and $750,000.

If you want to use the $25,000 to boost your budget to build a new home, it must be worth less than $750,000.

You will need to be an owner-occupier aged over 18, an Australian citizens and meet two income caps:

- Singles must be earning $125,000 or less based on their 2018/19 tax return or later.

- Couples must have a combined income of less than $200,000 based on their tax returns.

The money will be offered for any contracts entered into before December 31, 2020 and companies or trusts will not be eligible for the funding.

For renovators, the works must improve the “accessibility, safety and liveability” of the dwelling. The money cannot be used for additions to a property that are not connected to the principal place of residence such as swimming pools, tennis courts, outdoor spas and saunas, sheds or garages.

The work must be carried out by builders who were licensed or registered before the Government’s announcement.

The $25,000 grants are on top of existing State and Territory First Home Owner Grant programs, stamp duty concessions and other grant schemes, as well as the Commonwealth’s First Home Loan Deposit Scheme and First Home Super Saver Scheme.

The grants are available from today and will run until the end of the year.

More information can be found in this Fact Sheet and this FAQ document.

There is plenty of information to digest, so if you would like expert advice on your eligibility or any other information on the HomeBuilder scheme, call Walshs on 32215677 or email your relevant partner.

The information contained in this article is of a general nature only and does not take into account your particular objectives, financial situation or needs. Accordingly, the information should not be used, relied upon or treated as a substitute for specific financial advice. While all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Walshs nor its employees shall be liable on any ground whatsoever with respect to decisions or actions taken as a result of you acting upon such information.