Economic Outlook

The economic outlook was once again presented by the Chief Economist for KPMG Australia – Dr Brendan Rynne.

In 2023, he was one of the 20% of Australian economists that believed there would be no recession in the technical terms (two consecutive quarters of negative growth in real GDP), but he advised that it certainly would feel like one.

However, there were some areas where most economists missed the mark. The massive population growth that occurred in the 2022/23 financial year drove aggregate demand, which kept pushing inflation, and subsequently drove up the CPI rate. Dr Rynne forecasted an estimated RBA cash rate of 3.35%, however as we know this ended up being 4.35%. Interesting, looking back on the predictions, both NAB and Westpac predicted 4.10%, so almost hit the mark.

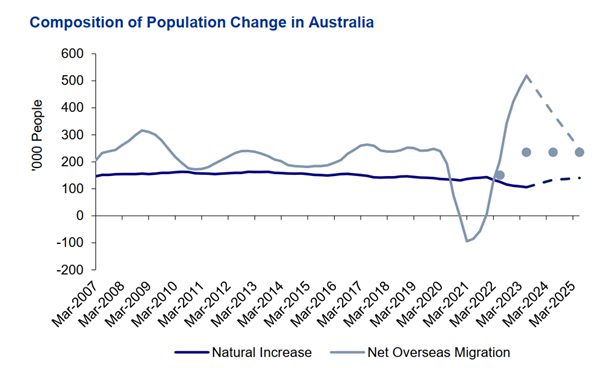

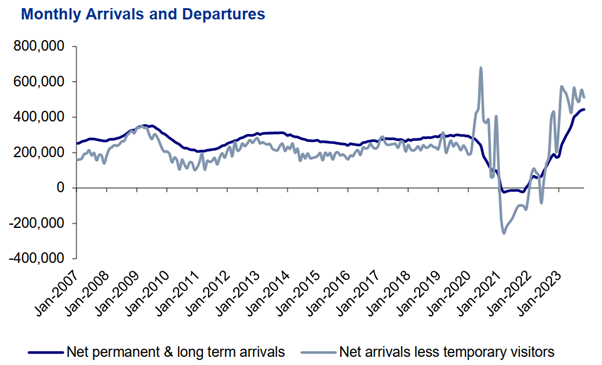

The charts below show the extent of the population growth during this period:

The outlook for the coming year certainly feels more positive, with the majority in the room confirming they felt this next year would be easier than the last one. From forecasts, it certainly is expected to be less volatile, and in line with a stable economic environment. This is especially true with the base interest rate expectations.

Migration looks like it has peaked from it’s surge in 2022/23. The unemployment has already started to push up to be more in line with the standard position of 4%. This return to normality will take some of the pressure off the wage growth, and thus driving down the inflationary environment that we have seen since covid times. There is an expectation that there will be two x 25 basis points reductions by the RBA during the 2024 year.

Queensland Property Outlook

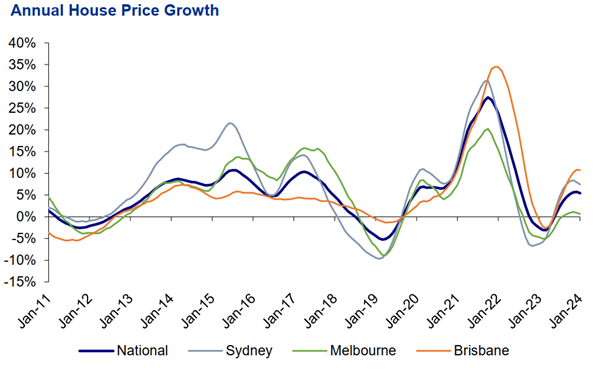

From a residential property perspective, although we saw reductions in the price of property in the beginning of 2023, they bounced straight back up again as you can see from the chart below:

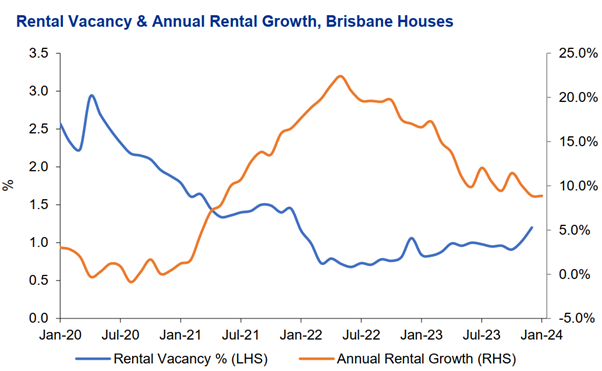

There were several factors contributing to this rebound, namely the large net overseas migration as discussed above. Secondly, the lack of new stock coming on to the market that contributes to the supply side of the equation. These factors also affected the rental market, which was a hot topic in the news last year. The situation is laid bare in the graph below:

Part of the presentation was dedicated to having a round table with some property industry experts, and developers. There was hope around the stage 3 tax cuts, and the possibility that a decrease in interest rates would increase household disposable income. A decrease in rates would certainly help developers who are currently having to contend with the increases in wages and materials, affecting their ability to get projects out of the ground.

Inevitably, the construction issues were at the forefront of discussions with Scott Hutchinson being one of the panellists.

“It seems to be coming off its peak,” Hutchinson said.

“We were doing probably 10 percent of what was coming in last year and it’s a little bit better than that now, but the industry is still madly overheated. But what’s starting to happen is the private work is stopping now and that needs to happen further.”

“You’ve got to pick the eyes out of the jobs you want and be careful who you work with,” Hutchinson said.

“The government is usually better than private work, that goes without saying. Government stuff gets the priority and long-term clients do.”

Current threats to be aware of in 2024:

- Continued issues with the approval process – building approvals have been falling for the last 8 years straight, and to correct this shortfall in housing won’t be an overnight fix as you can’t turn the tap back on and expect an immediate fix.

- There are still significant issues with the labour, and in SEQ it will only get worse with the current government infrastructure projects, 2032 Olympics developments and other large-scale developments around the state.

Current opportunities in 2024:

- The collaboration between developers and construction businesses is allowing more developments to get off the ground. It is allowing a de-risking of the projects that are being undertaken.

- There is still a strong high value/ luxury market. These markets are remaining rugged in both the house and apartment markets and look to remain that way for 2024.

By Tim Reece, Client Manager, Walshs Practice