Navigating the path to homeownership can be particularly challenging for junior doctors, whose income is often spread thin across training fees, relocation costs, and exam fees, leaving little room for saving cash for your first home or an investment property. But with property still being one of the biggest growth asset classes in Australia Walshs

Becoming a homeowner is a significant milestone that often begins with a myriad of questions, uncertainties, and excitement. For first home buyers, understanding the intricacies of the property market and navigating the mortgage landscape can be a daunting task. That’s where a mortgage broker becomes an invaluable ally, guiding prospective buyers through the complex process

If you’re considering a move into private practice, the process can certainly be a daunting prospect. There are many decisions to make, including the navigation of any financial pitfalls and long term planning to ensure financial success. Whether it’s starting with the right business structure, finding funding to establish your rooms, or protecting your growing

In the ever-evolving world of personal finance, making informed decisions about where to invest your hard-earned money is crucial. While traditional wisdom often advocates for paying down mortgages, there are times when embracing the potential of the stock market might be a more advantageous strategy. This blog post aims to explore why, especially in the

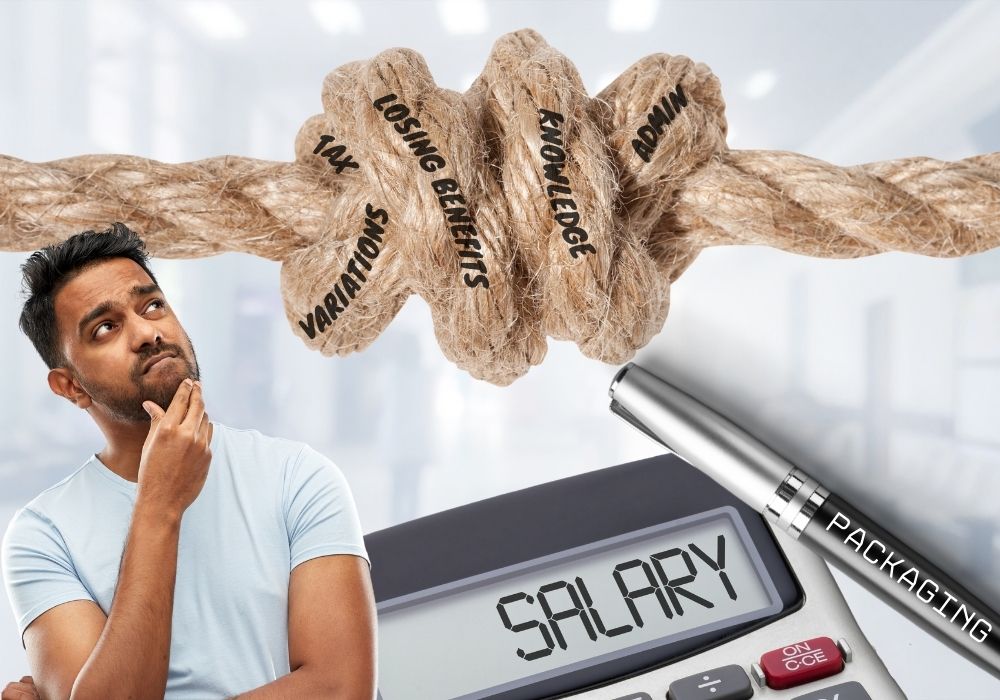

Salary Packaging is a remuneration arrangement that allows employees to receive a Fringe Tax Benefit by reducing their taxable income. There are significant financial advantages provided to employees who fall into the category of eligible participants, a group which includes many medical professionals. BUT navigating this process can be complex and certainly when moving between

Self-Managed Superannuation Funds (SMSFs) have become a popular investment vehicle in Australia, offering individuals greater control over their retirement savings. One intriguing avenue for SMSF investment is purchasing medical rooms. Not only does this provide a stable income stream, but it also allows healthcare professionals to secure their own practice premises. In this blog, we

Selling your rental property is a great opportunity to unlock some personal equity. But don’t forget the taxman wants a slice of the cake. Capital gains tax (CGT) is liable for the profits on the sale of property, however the capital gains tax 6 year rule provides some exemptions which can be utilised to optimise

Walshs are thrilled to announce the winner of the 2023 $10,000 Walshs Medical Bursary, Dr Luke Nottingham. The $10,000 in bursary funds will allow Dr Nottingham to take a small team of anaesthetists and anaesthetic trainees to The Colonial War Memorial Hospital in Suva, Fiji to facilitate a teaching workshop. Here they will provide additional

Being a Junior doctor can mean you’re income is spread thin across training fees, relocation costs and exams fees making it hard to save for a home. And with most banks requiring a 20% deposit to avoid the pricey Lender’s Mortgage Insurance (LMI), the hope of homeownership for many aspiring doctors is often a distant