(UPDATED 28 April 2025) As the Australian federal election approaches on May 3, 2025, it’s important to understand the tax policies proposed by the two major parties: the Australian Labor Party (Labor) and the Liberal-National Coalition (LNP). Below are some insights to help you understand their plans and consider how they might impact you. Labor’s

Key instant asset write-off changes The instant asset write-off incentive is a tax-saving initiative introduced by the Australian Government. It allows eligible businesses to deduct the full cost of certain assets in the year they are purchased, rather than claiming the cost over a number of years. Recently, the Government has announced that it will

The 2022-23 budget was handed down this week by Federal Treasurer Josh Frydenberg which encompassed the economic stability Australia is experiencing as it rebounds from the COVID-19 pandemic. Significant tax and productivity reforms were low on the agenda with focus mainly on key spending measures and continuing Australia’s post-pandemic, natural disaster and conflicted international environment

By Michael Walsh, CEO, Walshs COVID-19 has had a profound impact on individuals and businesses and the flow-on effects will likely be felt for some time. The Federal Budget 2020 includes a range of benefits and incentives, which hopefully will assist Australia to have a speedy recovery from our current economic position. Updates for individuals:

By Michael Walsh, CEO of Walshs The Federal Government has unveiled plans to extend its JobKeeper Payment by six months. The payment was originally due to expire on 27 September, 2020, but the Government has announced it will be extended by a further six months to March 2021, for eligible businesses and self-employed (called business

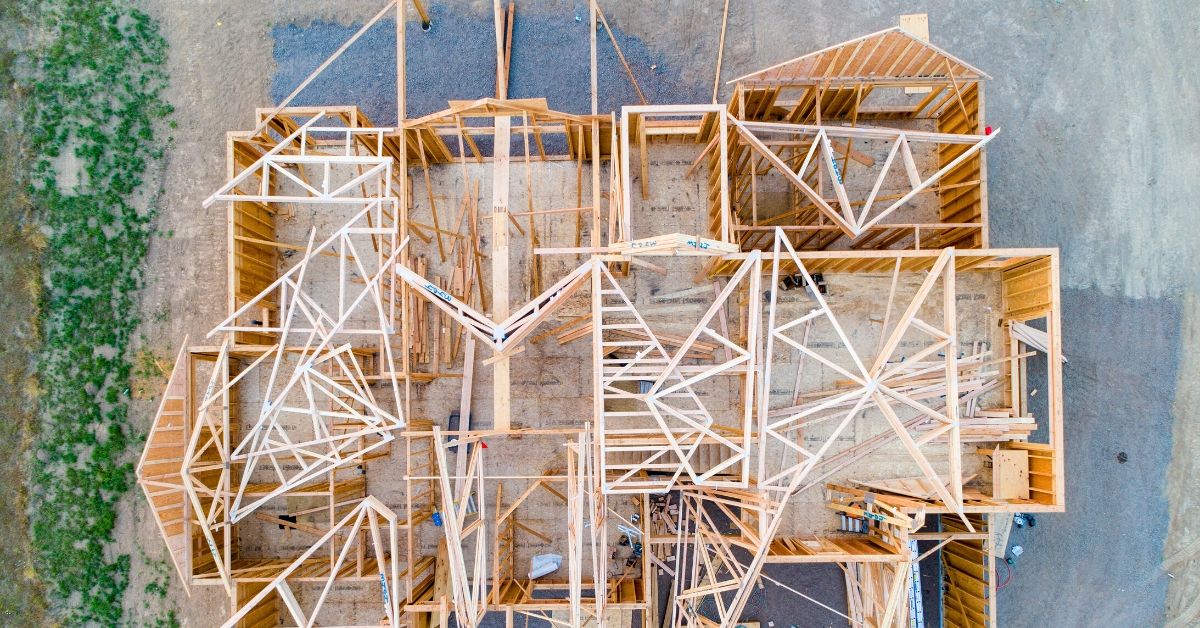

By Peter Hodgson, Financial Advisor at Walshs The Federal Government’s new HomeBuilder program is great news for Australia’s building industry, as well as people wanting to improve their homes. But it comes with strict criteria. Prime Minister Scott Morrison unveiled the program, which will give eligible Australians $25,000 to build or substantially renovate their homes,

How can surgeons take best advantage of government incentive schemes, should they be deferring paying their 2019 tax bills and is it too late to take a more defensive stand on superannuation funds? They are just some of the key questions posed by Walshs’ Simon Farmer and Hugh Walsh in a special video presentation aimed

By Michael Walsh, CEO of Walshs The Federal Government announced on 30 March, 2020, that it will introduce a business support package to help employers continue to employ their staff where the business has been affected by Coronavirus. The JobKeeper payment is designed to keep those currently employed in their jobs and legislation to approve it will

By Michael Walsh, CEO of Walshs Chartered Accountants and Financial Advisors The Coronavirus Stimulus Packages announced over the past week by Federal and State governments and the Australian Banking Association have major implications for small and medium businesses. Key items of interest for our clients are: BANK LOANS Bank loan repayments: The Australian Banking Association