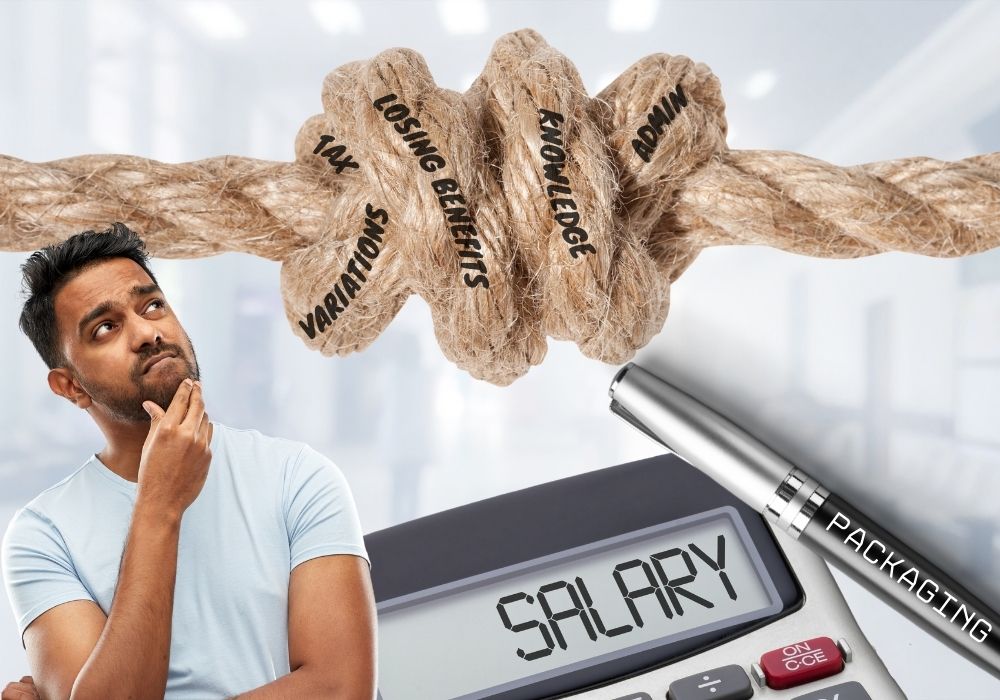

Salary Packaging is a remuneration arrangement that allows employees to receive a Fringe Tax Benefit by reducing their taxable income. There are significant financial advantages provided to employees who fall into the category of eligible participants, a group which includes many medical professionals. BUT navigating this process can be complex and certainly when moving between employers is can present some challenges.

In this article, we will delve into the main issues faced by eligible medical staff when changing employers whilst salary packaging, and outline the steps needed to ensure a seamless transition.

Challenges:

- Lack of understanding

- One of the primary challenges when changing employers and dealing with salary packaging lies in the lack of understanding about the intricacies of the process. Medical professionals are often invariably occupied with demanding schedules and patient care, leaving them with limited time to fully comprehend the details of their remuneration arrangements.

- Variability in packages

- Different employers offer varying salary packaging benefits, making it difficult to correctly ascertain what you are entitled to as a doctor. This variability can result in confusion and uncertainty about the potential benefits and drawbacks of each option.

- Tax implications

- While salary packaging can offer tax benefits, it also has tax implications associated with different packaging choices. A full understanding is needed so that salary packaging doesn’t lead to unexpected tax burdens down the line or the requirement to repay funds.

- Administration hassles

- The administrative aspects of transitioning between employers and managing salary packaging can be overwhelming. Employees may need to deal with paperwork, coordinate with different health departments and providers, and ensure compliance with regulatory requirements – all of which can be time-consuming and stressful.

- Loss of benefits

- Changing employers could potentially lead to a loss of accrued benefits or tenure in existing salary packaging arrangements. This loss can be disheartening and financially disadvantageous, especially for those who have been with an institution and/or provider for an extended period.

Navigate salary packaging changes effectively by following these steps to ensure a smooth transition:

- Educate yourself

- Prior to making any decisions, take the time to educate yourself about salary packaging. Research the different types of benefits that can be included such as superannuation contributions, fleet vehicles and work-related development courses. Seek guidance from human resources or financial advisers who specialise in healthcare renumeration. Your Walshs Financial adviser can assist you in commencing the process of salary packaging.

- Understand the language

- There are varying terms used when corresponding between employers and salary packaging providers. It is important to understand the language of packaging for making requests and ensuring your eligibility. The salary packaging ‘cap’ refers to your total entitlement and Fringe Benefit Tax (FBT) is the title of this benefit often referred to by providers and employers. The FBT Year commences from the 1st of April until the end of March.

- Carefully assess your needs

- Carefully assess your personal and financial needs to determine which salary packaging options align with your goals. Consider factors such as your family situation, long-term financial plans, and lifestyle preferences. By understanding your needs, you can make informed decisions about which benefits to prioritise.

- Compare offers

- When transitioning between employers, thoroughly compare the salary packaging options presented by each institution. Evaluate the benefits, tax implications, and potential drawbacks of each package. This comparison will empower you to make a choice that optimally suits your circumstances.

- Consider seeking professional advice

- Some financial professionals, like the team at Walshs, specialise in salary packaging for medical professionals. Experts can provide insights into tax-efficient strategies, help you understand the fine print of different packages, and guide you toward the most advantageous decision. Here at Walshs we have a dedicated salary packaging team who can assist you to understand and maximise your benefit.

- Plan for the transition

- As you switch employers, plan ahead for a smooth transition. If you have a Walshs financial adviser, communicate with them (or the salary packaging team) as early as you can about your intention to change salary packaging arrangements. If you don’t have an adviser, ensure that you have a clear understanding of the administrative requirements and deadlines involved. Contacting your provider in advance and communicating your intent to transition is imperative, as they can assist with determining whether your benefit needs to be maximised before your transition.

- Prioritise documentation

- Accurate and organised documentation is essential during the transition. Keep records of all communications, agreements and paperwork related to your salary packaging changes. This will help you address any discrepancies or issues that may arise in the future.

For some, the journey of changing employers while managing salary packaging can be tricky. The challenges of understanding the process, accessing options, and dealing with administrative complexities can often be overwhelming. However, by taking proactive steps to educate yourself, consider your personal and financial needs, plan ahead and seek professional advice, medical professionals can navigate these challenges effectively.

Walshs offers a Salary Packaging service for clients. This is a carefully considered and informed service for Queensland Health and Mater Queensland employees which includes:

- Tracking and managing clients’ entitlements, ensuring they are maximizing the benefits available to them.

- Communicating with the packaging providers on behalf of clients with the access allowed via third-party authorization.

- Making changes to clients’ packaging arrangements, based on their eligibility, and claimed expenses.

- Determining clients’ FBT eligibility based on any additional benefits incurred or changes within a role.

Our team can take the challenges of managing salary packaging out of your hands and ensure that you are able to focus on your career while we help to optimise your financial well-being.

If you would like more information on our services, please give us a call on 07 3221 5677 or email enquiries@walshs.com.au.