End-Of-Year Work Parties: What Employers Need to Know

- Published in Articles, Business, Walshs Blog

Holiday Travel or Business Expense? Avoiding Tax Trouble

- Published in Articles, Business, Walshs Blog

Unlocking your property opportunity: New 10 per cent deposit home loan

- Published in Articles, Business, Walshs Blog

10 Common (But Uncommon!) Questions We Are Asked During Tax Meetings

- Published in Articles, Business, Walshs Blog

Division 296 Updates: What high-balance superannuation members need to know

- Published in Articles, Business, Walshs Blog

Can you get a home loan for doctors without a 20% deposit?

- Published in Business, Walshs Blog

💔 Dealing with tax after losing a loved one: 10 steps to guide you

- Published in Articles, Uncategorized, Walshs Blog

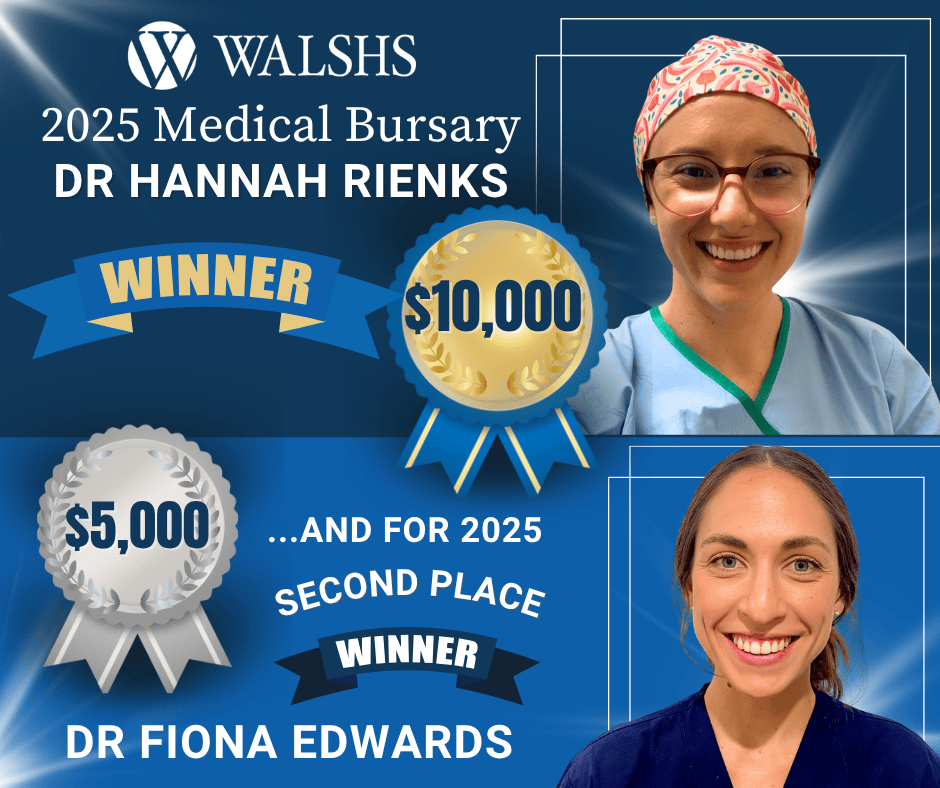

Meet our 2025 Walshs Medical Bursary winners – changing lives near and far!

- Published in Articles, Walshs Blog

Empowering orthopaedic surgeons nationwide: The BNN becomes an official national alliance partner of AOA

- Published in Uncategorized