The days of deciding on a tax strategy at the start of the financial year and then forgetting about it are gone, tax planning is an important part of managing your finances and requires careful consideration and strategic decision-making. As a tax payer you must be flexible, aware and ready to pivot at the right

Navigating the path to homeownership can be particularly challenging for junior doctors, whose income is often spread thin across training fees, relocation costs, and exam fees, leaving little room for saving cash for your first home or an investment property. But with property still being one of the biggest growth asset classes in Australia Walshs

Economic Outlook The economic outlook was once again presented by the Chief Economist for KPMG Australia – Dr Brendan Rynne. In 2023, he was one of the 20% of Australian economists that believed there would be no recession in the technical terms (two consecutive quarters of negative growth in real GDP), but he advised that

Becoming a homeowner is a significant milestone that often begins with a myriad of questions, uncertainties, and excitement. For first home buyers, understanding the intricacies of the property market and navigating the mortgage landscape can be a daunting task. That’s where a mortgage broker becomes an invaluable ally, guiding prospective buyers through the complex process

If you’re considering a move into private practice, the process can certainly be a daunting prospect. There are many decisions to make, including the navigation of any financial pitfalls and long term planning to ensure financial success. Whether it’s starting with the right business structure, finding funding to establish your rooms, or protecting your growing

In the ever-evolving world of personal finance, making informed decisions about where to invest your hard-earned money is crucial. While traditional wisdom often advocates for paying down mortgages, there are times when embracing the potential of the stock market might be a more advantageous strategy. This blog post aims to explore why, especially in the

There are so many specialist doctor home loans on the market that deciding which is best for you can be a minefield. The specialist home loans for doctors available can offer a lower interest rate and require less deposit than most other home loans. In most cases the banks will also forgo LMI (Lenders Mortgage

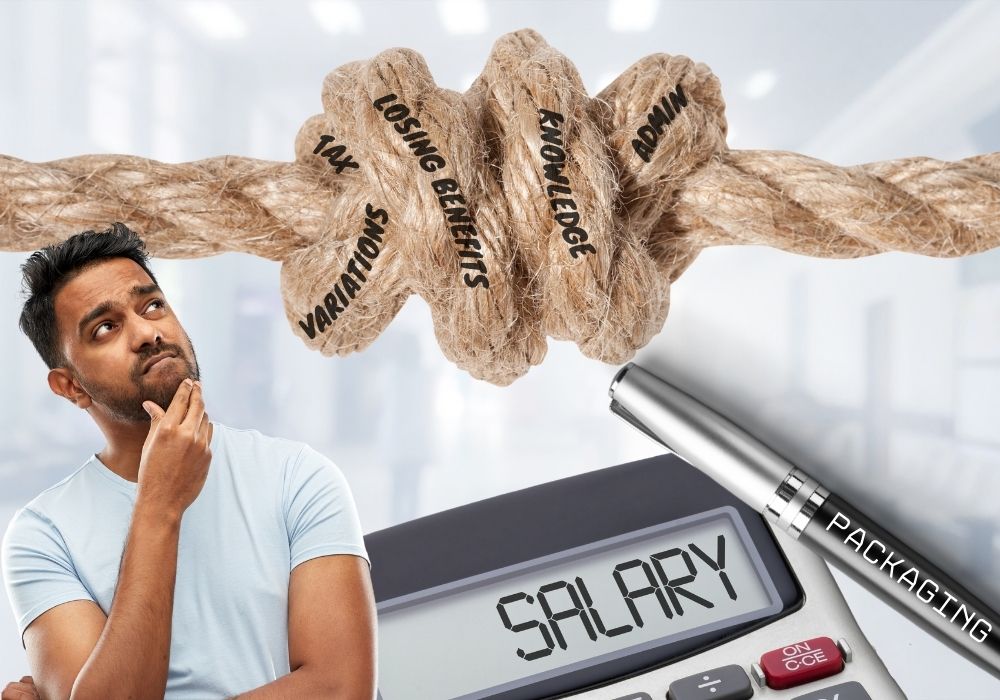

Salary Packaging is a remuneration arrangement that allows employees to receive a Fringe Tax Benefit by reducing their taxable income. There are significant financial advantages provided to employees who fall into the category of eligible participants, a group which includes many medical professionals. BUT navigating this process can be complex and certainly when moving between

We are delighted to share the news that the Walshs team has experienced great success throughout the year, securing #60 in the Australian Financial Review Top 100 Accounting Firms and as finalists within several categories at the Australian Accounting Awards 2023 and the IFA Excellence Awards 2023. These awards recognise outstanding contributions within the financial