Significant changes have been announced to the Government’s proposed Division 296 tax on superannuation earnings, which will particularly affect individuals with super balances above $3 million. For many Australians who have built significant retirement savings—particularly through self-managed superannuation funds (SMSFs)—understanding these changes is essential. On 13 October 2024, Treasurer Jim Chalmers announced key adjustments aimed

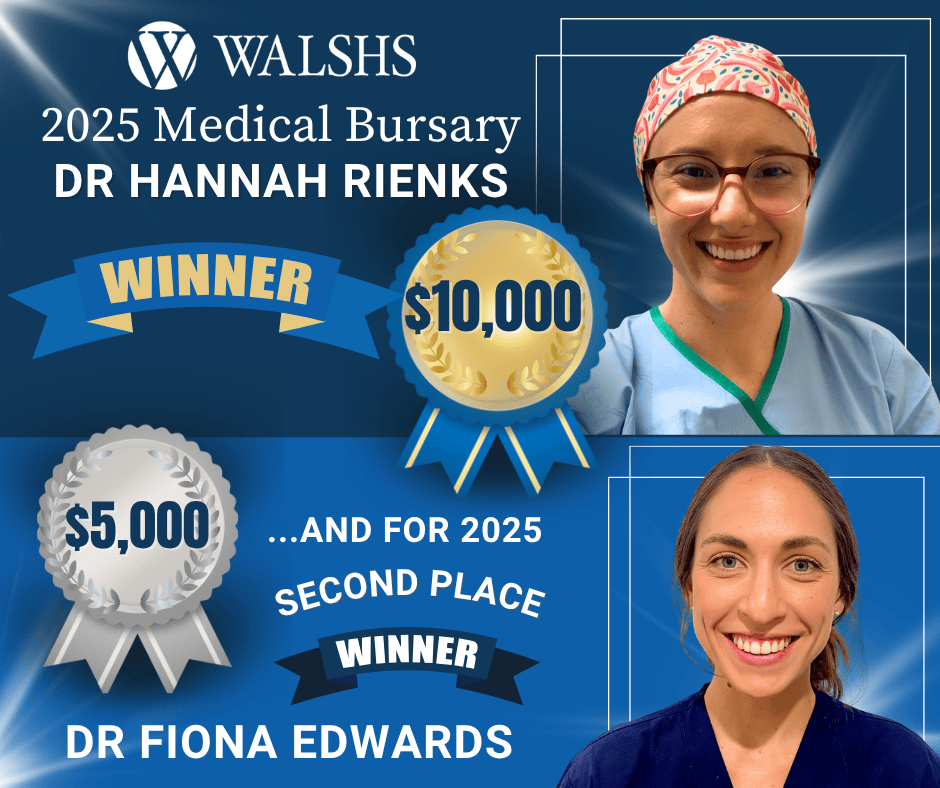

We’re absolutely thrilled to announce the winner of our 2025 Walshs Medical Bursary — and what an inspiring story it is! Congratulations to Dr Hannah Rienks, a fifth-year Obstetrics and Gynaecology Registrar (and proud Walshs client!) whose passion for women’s health is literally life-changing. Hannah will be heading to Kagando Hospital in western Uganda, joining

Walshs is delighted to announce that the Bongiorno National Network (BNN) has officially become an Alliance Partner of the Australian Orthopaedic Association (AOA). This exciting national partnership brings together Australia’s largest network of financial specialists for medical professionals with the country’s leading organisation representing orthopaedic surgeons, trainees, and researchers. A trusted partner for surgeons across

You may have seen headlines about the Albanese Government’s recently legislated 20% reduction in student debt – welcome news to many doctors and medical professionals still carrying HECS-HELP balances. So, when will it be applied and how does it affect your financial plans today? Let’s break it down. Has the 20% reduction happened yet? Yes

At Walshs, we’re all about helping you make smart financial moves that build long-term wealth. And for many Australians, one of the biggest steps on that journey is buying property – whether it’s a place to call home or a strategic investment. To cut through the noise and boost your confidence, we partnered with PMC

Walshs has strengthened ties with the Australian Orthopaedic Association (AOA) Queensland Branch as a Regional Alliance Partner. This collaboration reflects our shared commitment to supporting Queensland’s orthopaedic surgeons, trainees, and medical researchers by providing access to specialist financial advice, education, and resources tailored to the needs of medical professionals. For over 30 years, Walshs has

Gone are the days of setting a tax strategy at the start of the financial year and forgetting about it. In today’s ever-changing economic and legislative landscape, tax planning has become an essential part of managing your personal and business finances. To stay ahead, you need to be flexible, informed, and prepared to pivot your