If you’ve been thinking about buying your first home, there’s some big news making headlines.

From 1 October, the Federal Government is rolling out major updates to the First Home Buyer Guarantee Scheme.

The important thing to note is that medical professionals can already access these kinds of benefits through Walshs, with additional benefits!

What’s Changing in the Scheme?

Under the updated government scheme, first-home buyers will only need a 5% deposit, with the government guaranteeing the other 15%. That means no Lenders Mortgage Insurance (LMI) – a saving worth tens of thousands of dollars.

Other updates effective from 1 October include:

- No cap on places – You can re-apply under the new rules.

- Income thresholds removed – More households can qualify.

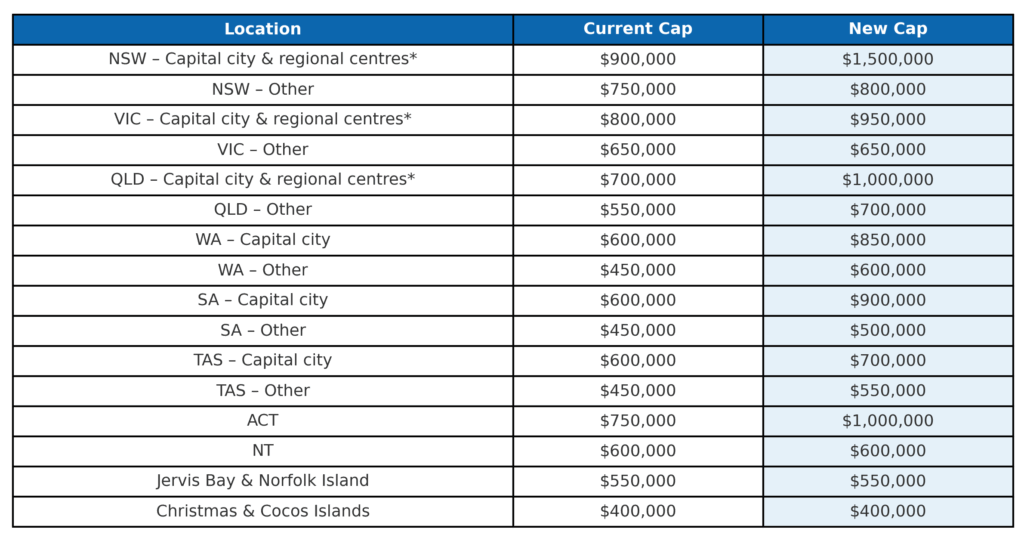

- Property price caps lifted – Reflecting today’s property market.

- New property price caps – see below!

👉 These changes won’t affect doctors directly, but they could really benefit your friends or colleagues. Feel free to point them our way – our broking team can guide them through the process and help secure approval.

Here’s how the numbers stack up (effective 1 October 2025):

How Walshs Already Goes Further for Medicos

Here’s the important part:

- Doctors already qualify for 5% deposit loans with no LMI through Walshs’ trusted lending partners – no government scheme required.

- Future income considered – Unlike standard lenders, we can factor in your projected earning potential as a doctor. This gives you greater borrowing capacity sooner.

- Tailored medical lending policies – Designed exclusively for medical professionals, making the process smoother, faster, and more favourable.

Our Proven Track Record

At Walshs, we’re not just mortgage brokers – we’re one of Australia’s largest medical-specific brokers, with:

- 30+ years of experience helping doctors achieve their financial goals

- Over $2 billion in lending facilitated for medical professionals

- A holistic service that integrates mortgage broking, tax planning, and financial advice – ensuring every decision supports your long-term financial success

Unlike banks or standard brokers who focus solely on loan products, we take a strategic approach – structuring your loan in a way that supports both today’s needs and tomorrow’s opportunities.

Why Speak to Walshs First?

If you’re a medical professional planning your first (or next) property purchase you don’t need to wait for the scheme to kick in – or worry about whether you qualify. We can already help you secure:

- Lower deposit requirements

- No LMI costs

- Higher servicing capacity

- Tailored strategies that grow your wealth over time

💡 And you don’t have to be a current Walshs client to benefit. Whether you’re new to us or already part of our community, our specialist lending team is here to help you take the next step with confidence.

Thinking about buying your first home? Talk to Walshs today. We’ll make sure you’re not just taking advantage of the headlines – but securing the very best deal available to you as a medico.

And if you know a colleague, friend, or family member who isn’t a medical professional but could benefit from these new government updates, connect them with us. Our broking team would be delighted to help them too.

📞 Give us a call on 07 3221 5677 or book a meeting today.