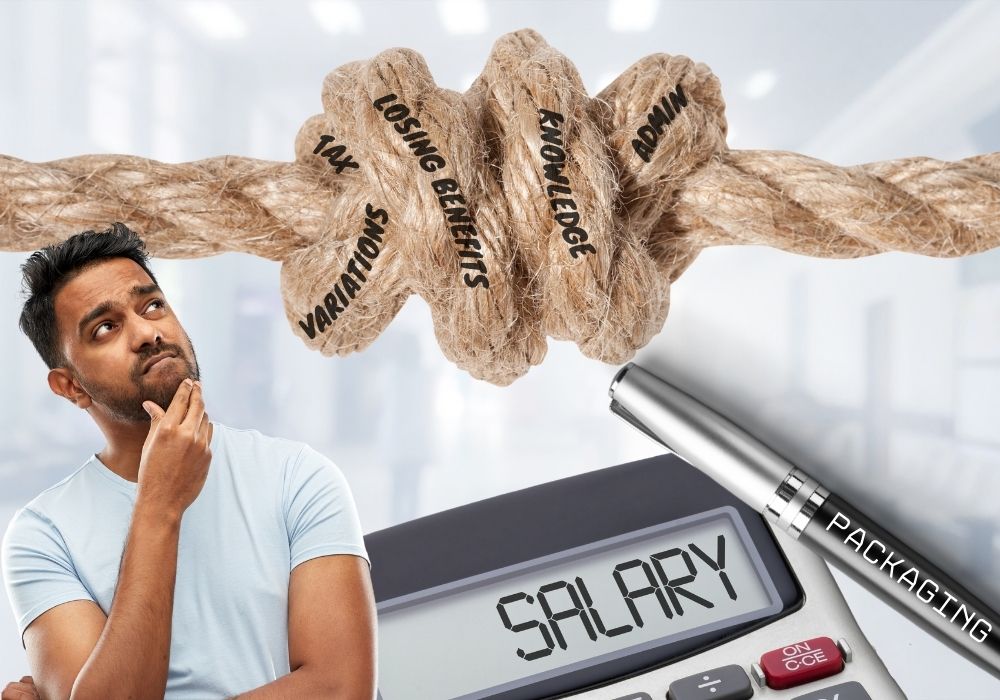

Salary Packaging is a remuneration arrangement that allows employees to receive a Fringe Tax Benefit by reducing their taxable income. There are significant financial advantages provided to employees who fall into the category of eligible participants, a group which includes many medical professionals. BUT navigating this process can be complex and certainly when moving between

We are delighted to share the news that the Walshs team has experienced great success throughout the year, securing #60 in the Australian Financial Review Top 100 Accounting Firms and as finalists within several categories at the Australian Accounting Awards 2023 and the IFA Excellence Awards 2023. These awards recognise outstanding contributions within the financial

Self-Managed Superannuation Funds (SMSFs) have become a popular investment vehicle in Australia, offering individuals greater control over their retirement savings. One intriguing avenue for SMSF investment is purchasing medical rooms. Not only does this provide a stable income stream, but it also allows healthcare professionals to secure their own practice premises. In this blog, we

Tax planning is an essential aspect of financial management that requires careful consideration and strategic decision-making. One effective way to ensure optimal tax management is by engaging in regular tax planning meetings with your accountant at Walshs. These meetings provide a valuable opportunity to collaborate, analyse, and develop personalised strategies to navigate the complexities of

As a newly self-employed doctor, there are a significant number of considerations that need to be worked through, for example; registering for GST, managing practice obligations, managing tax liabilities and finding new patients. Often, growing wealth at this time can be difficult or become a low priority. When moving into private practice, you become self-employed

We are proud to announce that Walshs has recently gained another incredible accolade having been named the winner in the category of ‘Self-Licenced Firm of the Year’ at the recent IFA Excellence Awards held on the 16th November in Sydney. These awards celebrate the best and brightest in the financial services industry nationally and we are thrilled to be

On the evening of Tuesday 25 October 2022, Australia’s Treasurer, Jim Chalmers, delivered the nation’s 2022-23 Budget, Labor’s first since taking office earlier this year. While the Budget features a couple of key proposals aimed at providing cost-of-living relief for young families, it had a fairly light touch in the areas of taxation, superannuation and

July 2022 saw a number of changes to the superannuation rules and many will have a positive outcome for members of superannuation funds. The changes were announced and legislated by the Morrison government so it’s important to note that the new government will be delivering its first Budget in October 2022. The superannuation tax concessions could be

Your team are the lifeblood of your medical practice and a key element to the success of your business. When commencing the process of employing staff, there are many factors that must be considered to prepare your business for the recruitment process and to manage the ongoing payroll and employment demands with ease, whilst still