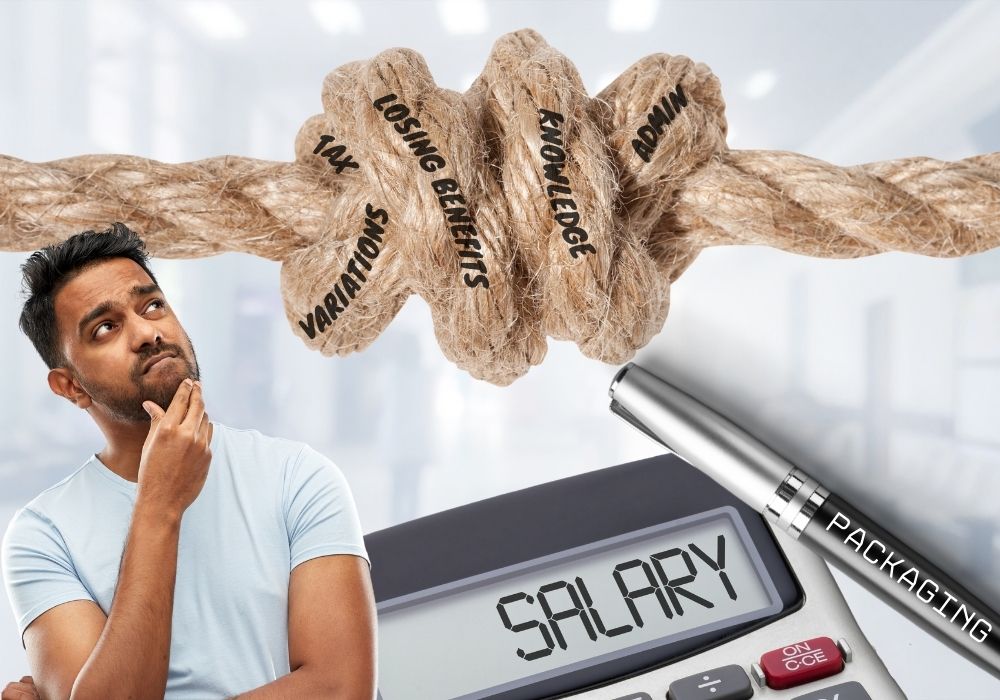

Salary Packaging is a remuneration arrangement that allows employees to receive a Fringe Tax Benefit by reducing their taxable income. There are significant financial advantages provided to employees who fall into the category of eligible participants, a group which includes many medical professionals. BUT navigating this process can be complex and certainly when moving between

Salary Packaging provides you with a method of using pre-tax funds to pay for certain items with an eligible employer. If you work for a public benevolent organisation, you may be eligible for this benefit (e.g. Public Health, Research Institutes, etc.) What are the benefits Instead of your income being taxed, coming to you, and

By Peter Hodgson, Financial Planner with Walshs If you work in Queensland’s hospital system and have changed which hospital you work at in the past year, you may be entitled to significant tax savings through your salary packaging, while Resident Medical Officers (RMOs) may be eligible for a substantial Vocational Training Subsidy. It is important