How do you keep your finances on track when a medical career demands so much of your focus and time? The journey of a medical professional is unique, marked by long hours, intensive (and expensive!) study and unexpected relocations and other fun twists. Financial management is a critical part of sustaining this journey, yet it’s

Mental health challenges can be debilitating, affecting every aspect of life, including the ability to work and maintain financial stability. For medical professionals, whose roles are often high-pressure and demanding, these challenges can be particularly acute. This is where the importance of mental health insurance claims comes into play, providing a crucial safety net during

The medical field in Australia offers a wide variety of specialties, each with its own unique path, responsibilities, and rewards. For doctors, the journey from intern to consultant is long, but it can lead to a fulfilling and lucrative career. Understanding the earning potential at different stages is crucial for those deciding on a specialty

Accounting for doctors involves unique financial challenges that, if not managed correctly, can result in costly mistakes. Whether it’s tax inefficiencies or missing out on key deductions, avoiding these pitfalls can make a real difference to your financial success. Below are some of the most common mistakes that we have seen doctors make, along with

In the fast-paced world of healthcare, managing a medical practice efficiently is no small feat. Between patient care, administrative tasks, and regulatory compliance, the financial side of your practice often requires expert attention. This is where outsourcing medical accounting services can make a significant difference, transforming how you run your practice. The Complexities of Medical

Whether you’re running a medical practice or working as a healthcare professional, the unique financial challenges you face can be significantly eased with the help of a specialised medical accounting firm. In this blog, we address some frequently asked questions about medical accounting, and how specialised support can help you better manage your finances and

The 2024-25 Federal Budget, unveiled on Tuesday, May 14, 2024, brings notable changes impacting individuals, businesses, and superannuation. Among the highlights are the eagerly anticipated Stage 3 Tax Cuts, reducing tax rates and raising income thresholds for higher tax brackets starting July 1, 2024. For businesses, the Instant Asset Write-Off is extended, providing small businesses

The days of deciding on a tax strategy at the start of the financial year and then forgetting about it are gone, tax planning is an important part of managing your finances and requires careful consideration and strategic decision-making. As a tax payer you must be flexible, aware and ready to pivot at the right

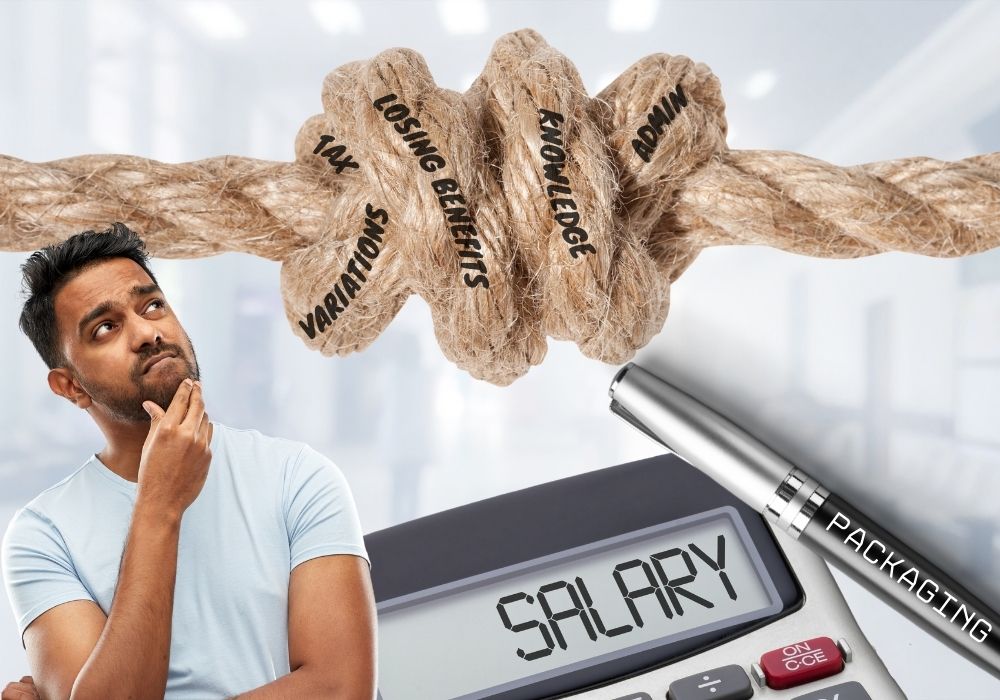

Salary Packaging is a remuneration arrangement that allows employees to receive a Fringe Tax Benefit by reducing their taxable income. There are significant financial advantages provided to employees who fall into the category of eligible participants, a group which includes many medical professionals. BUT navigating this process can be complex and certainly when moving between

We are delighted to share the news that the Walshs team has experienced great success throughout the year, securing #60 in the Australian Financial Review Top 100 Accounting Firms and as finalists within several categories at the Australian Accounting Awards 2023 and the IFA Excellence Awards 2023. These awards recognise outstanding contributions within the financial