Mental health challenges can be debilitating, affecting every aspect of life, including the ability to work and maintain financial stability. For medical professionals, whose roles are often high-pressure and demanding, these challenges can be particularly acute. This is where the importance of mental health insurance claims comes into play, providing a crucial safety net during

The medical field in Australia offers a wide variety of specialties, each with its own unique path, responsibilities, and rewards. For doctors, the journey from intern to consultant is long, but it can lead to a fulfilling and lucrative career. Understanding the earning potential at different stages is crucial for those deciding on a specialty

Accountants play an important role in assisting business owners with navigating complex processes. One such aspect demanding careful attention pertains to claiming deductions for depreciating assets. Let’s delve into the strategic timing for claiming deductions, the various types of depreciating assets, and the significance of maintaining precise records to optimise tax benefits. Strategic timing

The days of deciding on a tax strategy at the start of the financial year and then forgetting about it are gone, tax planning is an important part of managing your finances and requires careful consideration and strategic decision-making. As a tax payer you must be flexible, aware and ready to pivot at the right

Navigating the path to homeownership can be particularly challenging for junior doctors, whose income is often spread thin across training fees, relocation costs, and exam fees, leaving little room for saving cash for your first home or an investment property. But with property still being one of the biggest growth asset classes in Australia Walshs

Becoming a homeowner is a significant milestone that often begins with a myriad of questions, uncertainties, and excitement. For first home buyers, understanding the intricacies of the property market and navigating the mortgage landscape can be a daunting task. That’s where a mortgage broker becomes an invaluable ally, guiding prospective buyers through the complex process

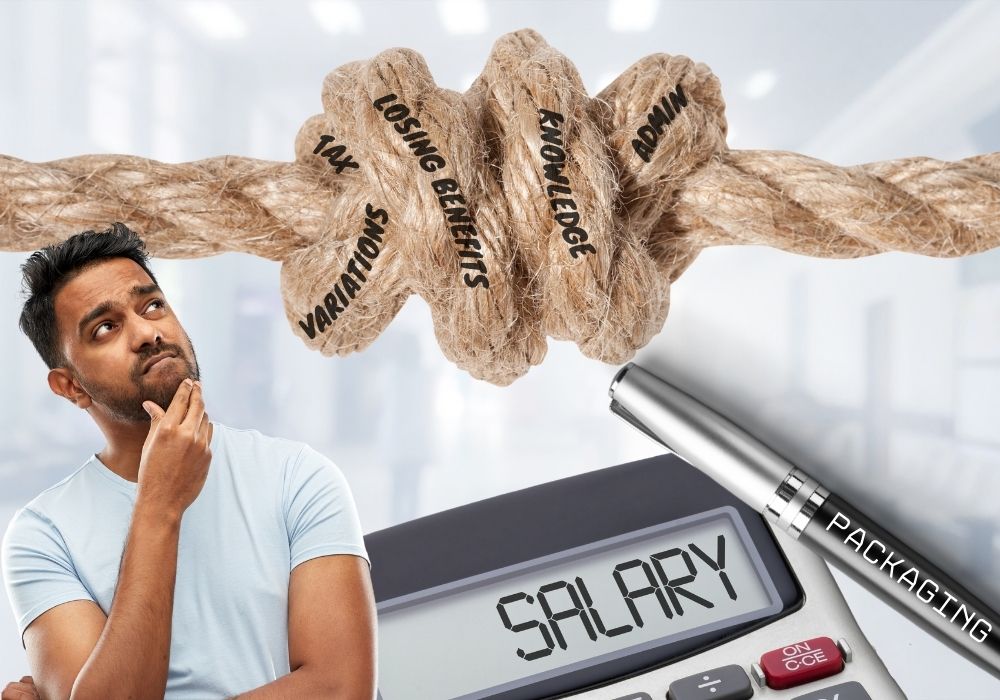

Salary Packaging is a remuneration arrangement that allows employees to receive a Fringe Tax Benefit by reducing their taxable income. There are significant financial advantages provided to employees who fall into the category of eligible participants, a group which includes many medical professionals. BUT navigating this process can be complex and certainly when moving between

We are delighted to share the news that the Walshs team has experienced great success throughout the year, securing #60 in the Australian Financial Review Top 100 Accounting Firms and as finalists within several categories at the Australian Accounting Awards 2023 and the IFA Excellence Awards 2023. These awards recognise outstanding contributions within the financial

By now you would have heard about the asset class Build to Rent (BTR), which is a relative newcomer to the Queensland market. What does it entail, what are the benefits, and, of course what are some of the current tax considerations relevant for developers. What is it and what are the benefits? In Australia,

Tax planning is an essential aspect of financial management that requires careful consideration and strategic decision-making. One effective way to ensure optimal tax management is by engaging in regular tax planning meetings with your accountant at Walshs. These meetings provide a valuable opportunity to collaborate, analyse, and develop personalised strategies to navigate the complexities of