Embarking on the journey to purchase your first home is both exciting and daunting. One of the significant costs to consider is stamp duty, a state-based tax imposed on the purchase of residential property. Fortunately, many state governments in Australia have introduced incentives to help first home buyers reduce or even waive this tax, making it easier to enter the property market sooner. In this article, we will explore these recent changes and how they might benefit you.

Understanding stamp duty and its impact

Stamp duty is a substantial expense that can add thousands of dollars to the cost of purchasing a property. The amount of stamp duty payable varies significantly depending on the state or territory in which you are buying. Recognising the financial burden this imposes, several state governments have implemented measures to assist first home buyers.

State-based stamp duty incentives

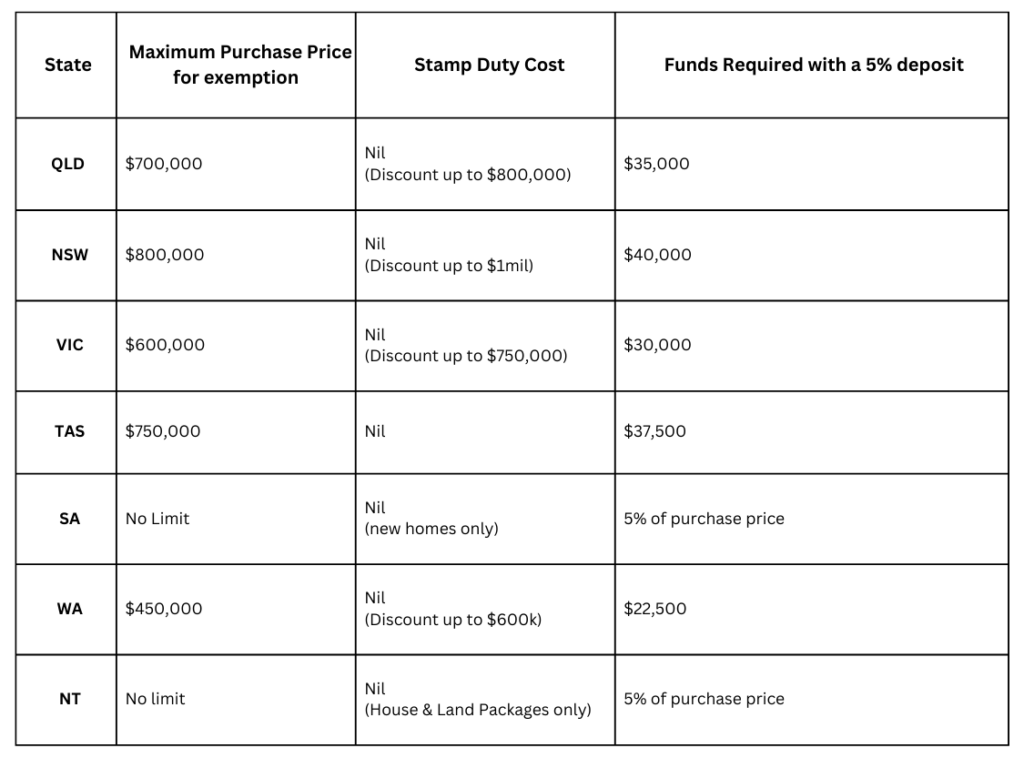

The following table summarises the stamp duty incentives available for first home buyers across different states and territories in Australia:

How these changes can benefit you

These incentives can significantly reduce the upfront costs associated with purchasing your first home, allowing you to enter the property market sooner than you might have otherwise. For example, if you are purchasing a property in Queensland valued at $700,000, you could save $17,350 in stamp duty.

However, it is important to understand the specific eligibility criteria and application processes for these incentives, as they can vary from state to state. This is where professional advice can be invaluable.

Take advantage of the changes with these steps

1. Check your eligibility

Confirm that you qualify for the first home concession. This includes being at least 18 years old, never having owned property in Australia or abroad, and intending to live in the home as your primary residence.

2. Calculate your savings

Use the website links below, or for Queensland purchases use this stamp duty calculator to determine your potential savings under the new rules. This will give you a clearer understanding of your financial position and help you plan your budget more effectively. The updated rules apply to contracts signed on or after June 9, 2024. Contracts signed before this date will follow the previous thresholds.

3. Maximise benefits

If you are building a new home, remember to apply for the First Home Owner Grant. Combining this grant with the stamp duty concessions can reduce your overall costs and make the process more manageable.

4. Book a meeting with your financial adviser

To navigate these changes effectively and maximise the benefits available to you, consider booking a meeting with your financial adviser. A financial adviser can provide personalised advice tailored to your financial situation and goals. They can help you understand:

• The specific stamp duty incentives available in your state or territory.

• The eligibility criteria and application process for these incentives.

• The best locations to buy in to benefit from these incentives.

• Strategies to align your home purchase with your long-term financial goals.

For more detailed information on the eligibility criteria and application processes for each state’s stamp duty incentives, you can visit the following State Government websites:

Victoria

New South Wales

Queensland

Tasmania

South Australia

Western Australia

Northern Territory

As a first home buyer these incentives are designed to ease your entry into the property market and Walshs are here to help you work through the process to ensure you make the most of substantial savings.

Feel free to book a meeting with your financial adviser via this link to explore how these changes can benefit you on your journey to purchasing your first home.

Article by: Daniel James, Walshs Financial Adviser