A breach in your security systems or failure to backup could jeopardise your business’ productivity and profitability. Every year you should take time to secure your data to prevent panic should your computer systems fail. The effectiveness of backups relies on frequency and the type of technology used. For long-term solutions, avoid using USB and

Avoid leaving your business’ future in the dark by understanding your rights when your lease is up for renewal. A retail or commercial lease is a legally binding contract between a landlord and a tenant of a retail shop that allows the tenant to use the landlord’s property in return for rental payments. The process of

The Australian Tax Office (ATO) is reminding employers using Small Business Superannuation Clearing House (SBSCH) to check their employee details are accurate when making payment. Submitting incorrect employee details can risk their super fund rejecting your payment and returning the amount to the ATO. Once the ATO receives your payment, they will contact you and require

When it comes to how the super death benefit is paid out, there are specific tax implications involved which affect the amount a nominated beneficiary will receive. In a situation where super is paid out after an individual has passed, it is generally split up into two components; taxable and tax-free. The tax-free portion of a super

Family trusts and self-managed super funds (SMSFs) have a lot to offer Australians as wealth transfer and management tools. Family trusts and SMSFs carry their own benefits and disadvantages in providing a way to transfer and manage your family’s wealth. By weighing up the points of difference, you can choose the most appropriate option for

Strict investment rules govern how trustees can acquire assets through self-managed super funds (SMSF) from related parties. When it comes to acquiring an asset from a related party, a trustee must ensure it is an ‘arm’s length transaction’, in other words, the asset is purchased at market value. This means ensuring it is also: •

Following a tour of the Leukaemia Foundation’s ESA Village in August, CEO Michael Walsh has announced Walk with Walshs will now become an annual event. The second annual Walk with Walshs will be held on 17 – 18 August 2019. The two-day 55km trek through the Sunshine Coast hinterland was first held in May this

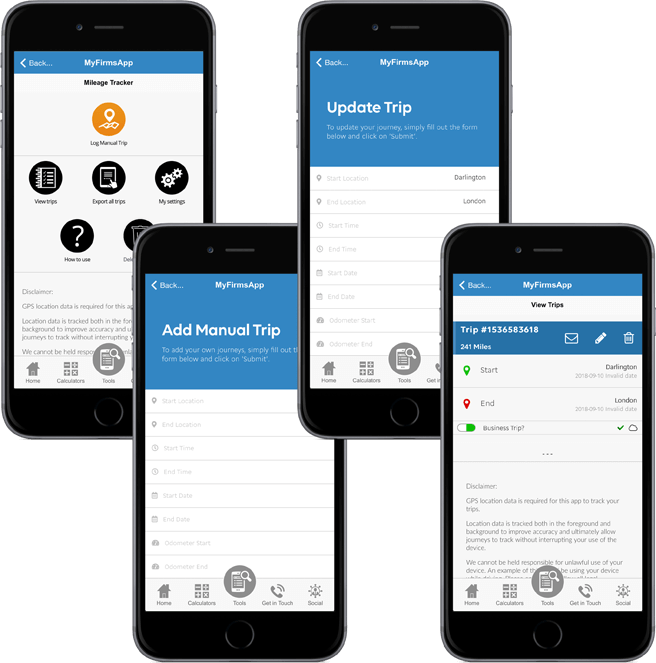

We launched the new Walshs App just last month and now we have made our first update, with a state-of-the-art GPS Logbook, using advanced GPS technology to accurately track both your business and personal trips. We’ve added this enhancement so you can use the GPS Logbook within our App to help prepare for your tax returns, and track daily

Businesses with an annual turnover less than $10 million (from 1 July 2016) can claim the $20,000 instant asset write-off. If you buy an asset and it costs less than $20,000, you can write off the business portion in your tax return for the relevant income year. You are eligible to use simplified depreciation rules and

The Australian Taxation Office (ATO) has announced changes to the way GST is collected at settlement. According to the ATO, if you are purchasing new residential premises or potential residential land you are required to withhold part of the purchase price for payment (to the ATO) must submit a number of online forms. These forms