Helping to Grow your Business The Queensland Government funded BGF program provides funding for small and medium-sized businesses who experience high-growth to assist with the purchasing of specialised equipment to further growth potential, increase production, and support employee expansion and higher economic returns. Small to medium sized business owners who are financially sound, and can

By Michael Walsh, CEO, Walshs Job losses have been extensive during the COVID-19 pandemic and the JobMaker Hiring Credit will give businesses incentives to take on additional employees aged between 16 and 35 years old. The Federal Government estimates the initiative will support 450,000 jobs. Like JobKeeper, the JobMaker Hiring Credit is a wage subsidy paid

By Michael Walsh, CEO, Walshs COVID-19 has had a profound impact on individuals and businesses and the flow-on effects will likely be felt for some time. The Federal Budget 2020 includes a range of benefits and incentives, which hopefully will assist Australia to have a speedy recovery from our current economic position. Updates for individuals:

By Michael Walsh The Federal Government has extended the JobKeeper Scheme for eligible businesses and self-employed workers for a further six months to March 2021 (previously due to expire 27 September, 2020). Businesses will need to reassess their eligibility for the JobKeeper 2.0 Scheme, and those eligible will receive a reduced rate of payments for their employees based

By Peter Hodgson of Walsh’s Financial Planning The 2019/20 financial year began with strong momentum across most financial markets. However, as the year progressed, unemployment drifted higher and, coupled with benign inflationary pressures, many countries began to lower interest rates further in response. As the financial year headed towards March, COVID-19 rapidly spread across the

By Michael Walsh, CEO of Walshs Practice If you operate a Self-Managed Superannuation Fund (SMSF), you should be aware that there are compliance obligations you must meet and that non-compliant funds may be subject to ATO sanctions or penalties. An SMSF trustee who does not meet compliance requirements might be forced to undertake an education

By Michael Walsh, CEO of Walshs Practice If you’re an employer who has failed to make Superannuation Guarantee (SG) payments to your workers, you have until September 7 to apply for an amnesty. The amnesty is a one-off opportunity for employers to correct any payment mistakes and we are urging them to take advantage of

By Michael Walsh, CEO of Walshs The Federal Government has unveiled plans to extend its JobKeeper Payment by six months. The payment was originally due to expire on 27 September, 2020, but the Government has announced it will be extended by a further six months to March 2021, for eligible businesses and self-employed (called business

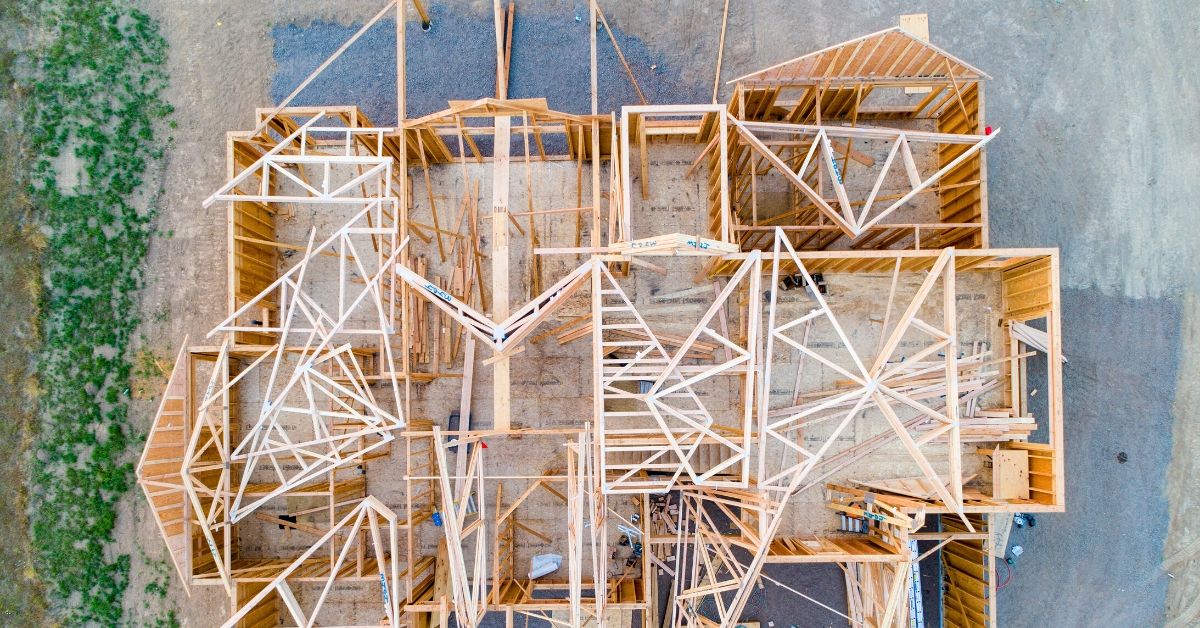

By Peter Hodgson, Financial Advisor at Walshs The Federal Government’s new HomeBuilder program is great news for Australia’s building industry, as well as people wanting to improve their homes. But it comes with strict criteria. Prime Minister Scott Morrison unveiled the program, which will give eligible Australians $25,000 to build or substantially renovate their homes,