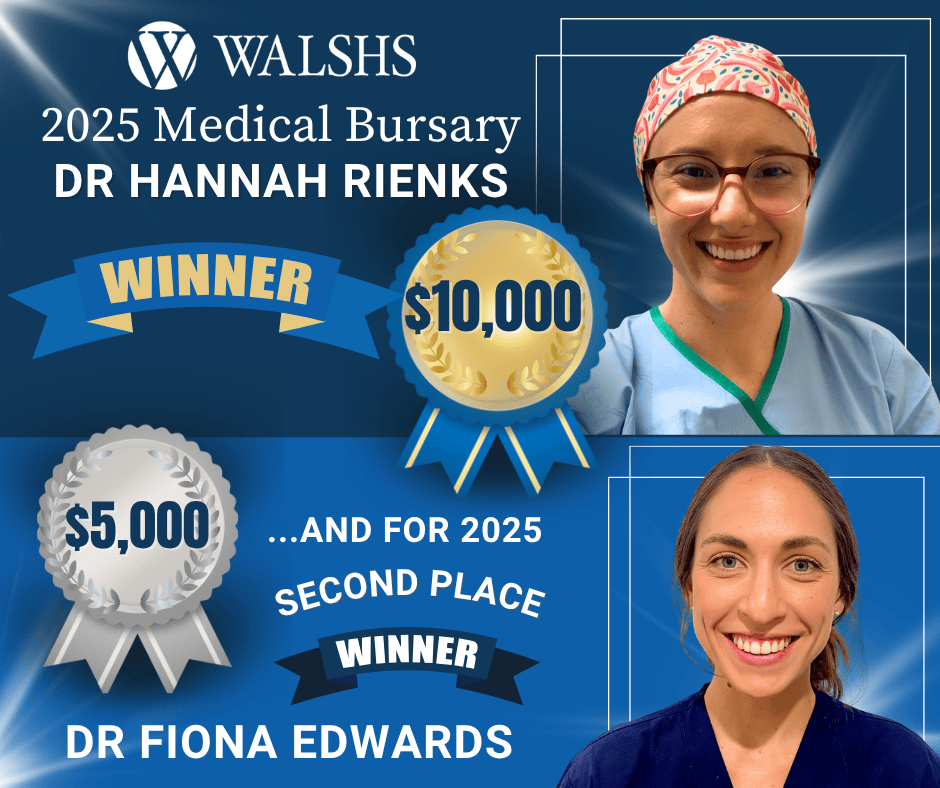

We’re absolutely thrilled to announce the winner of our 2025 Walshs Medical Bursary — and what an inspiring story it is! Congratulations to Dr Hannah Rienks, a fifth-year Obstetrics and Gynaecology Registrar (and proud Walshs client!) whose passion for women’s health is literally life-changing. Hannah will be heading to Kagando Hospital in western Uganda, joining

You may have seen headlines about the Albanese Government’s recently legislated 20% reduction in student debt – welcome news to many doctors and medical professionals still carrying HECS-HELP balances. So, when will it be applied and how does it affect your financial plans today? Let’s break it down. Has the 20% reduction happened yet? Yes

At Walshs, we’re all about helping you make smart financial moves that build long-term wealth. And for many Australians, one of the biggest steps on that journey is buying property – whether it’s a place to call home or a strategic investment. To cut through the noise and boost your confidence, we partnered with PMC

Walshs has strengthened ties with the Australian Orthopaedic Association (AOA) Queensland Branch as a Regional Alliance Partner. This collaboration reflects our shared commitment to supporting Queensland’s orthopaedic surgeons, trainees, and medical researchers by providing access to specialist financial advice, education, and resources tailored to the needs of medical professionals. For over 30 years, Walshs has

Gone are the days of setting a tax strategy at the start of the financial year and forgetting about it. In today’s ever-changing economic and legislative landscape, tax planning has become an essential part of managing your personal and business finances. To stay ahead, you need to be flexible, informed, and prepared to pivot your

Accounting for doctors in 2025 has evolved far beyond tax-time basics. As cloud-based systems, automation, predictive analytics and secure integrations become the norm, doctors now have access to accounting that is faster, smarter, and more tailored to their career. But with these advancements also comes a shift in expectations — today’s medical professionals need more

(UPDATED 28 April 2025) As the Australian federal election approaches on May 3, 2025, it’s important to understand the tax policies proposed by the two major parties: the Australian Labor Party (Labor) and the Liberal-National Coalition (LNP). Below are some insights to help you understand their plans and consider how they might impact you. Labor’s

Are you ready to take your private practice to the next level? Look no further than the latest episode of the Practice Masterclass Series by Magentus, featuring the expertise of Walshs Director, Hugh Walsh. In this 20-minute video, Hugh delves into essential financial strategies specifically designed for private practice owners. Key Topics Covered: Choosing the