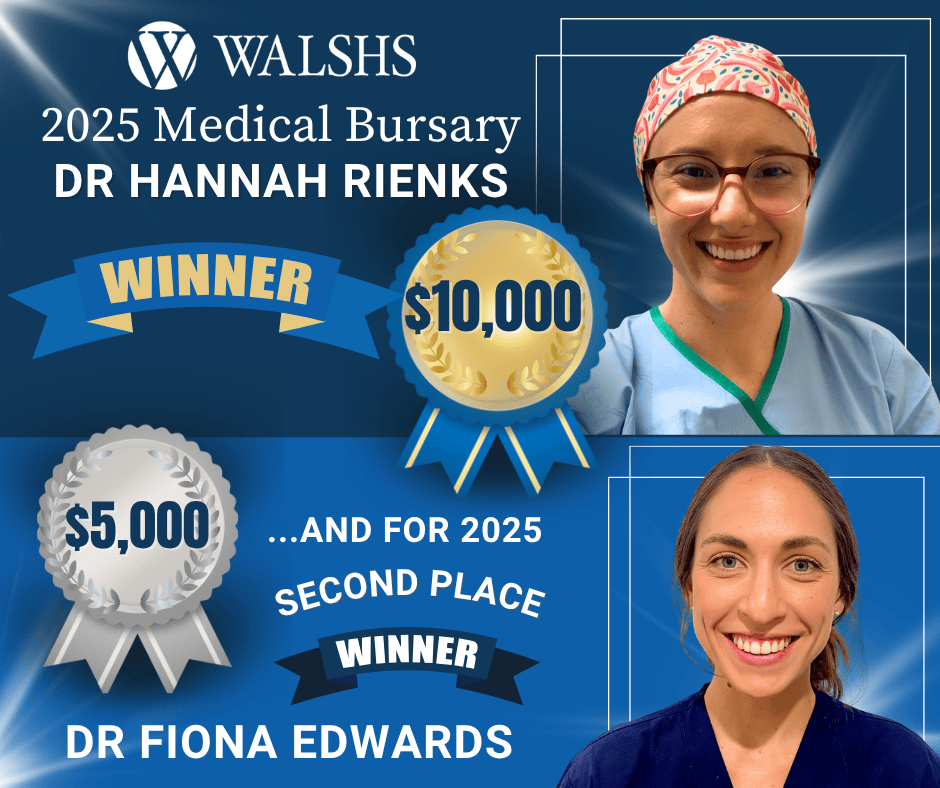

We’re absolutely thrilled to announce the winner of our 2025 Walshs Medical Bursary — and what an inspiring story it is! Congratulations to Dr Hannah Rienks, a fifth-year Obstetrics and Gynaecology Registrar (and proud Walshs client!) whose passion for women’s health is literally life-changing. Hannah will be heading to Kagando Hospital in western Uganda, joining

If you’re considering a move into private practice, the process can certainly be a daunting prospect. There are many decisions to make, including the navigation of any financial pitfalls and long term planning to ensure financial success. Whether it’s starting with the right business structure, finding funding to establish your rooms, or protecting your growing

If you’re considering a move into private practice, the process can certainly be a daunting prospect. There are many decisions to make, including the navigation of any financial pitfalls and long term planning to ensure financial success. Whether it’s starting with the right business structure, finding funding to establish your rooms, or protecting your growing

By Sharon Aguiar, Senior Accountant, Walshs The NSW and Victorian Office of State Revenue (OSR) have been actively engaging in payroll tax audits for medical and dental practices. The NSW OSR has conducted at least 20 audits in the last 18 months. The problem Broadly speaking, the NSW and Victorian OSRs have held the view

How can surgeons take best advantage of government incentive schemes, should they be deferring paying their 2019 tax bills and is it too late to take a more defensive stand on superannuation funds? They are just some of the key questions posed by Walshs’ Simon Farmer and Hugh Walsh in a special video presentation aimed