As we move further into 2025, Queensland’s property market and economic landscape remain at the forefront of discussion for investors, developers, and policymakers alike. Walshs Associate, Tim Reece recently attended the 2025 Urban Developers QLD Property & Economic Outlook, presented by Terry Rawnsley from KPMG Australia. In this article he shares key insights from the discussion, on where the market is heading, the challenges that remain, and the opportunities emerging across residential, commercial, and industrial property sectors.

Economic Outlook

The outlook for the coming year certainly feels positive, with the majority in the room confirming they felt bullish about 2025, and the future of the economy, especially in SEQ. Unfortunately, geopolitics have again become a forefront contribution of instability in markets.

The labour market remains strong in Australia, with the unemployment expected to remain at 4%. The overall economy is still soft; however the GDP growth rate is forecasted to rise from 1.5% in 2024 to 2.4% in 2025.

There were three major topics discussed – inflation, rates, and productivity.

These are quite obviously the hot topics for the last couple of years as we have come out of Covid times, and with inflation becoming sticky, it doesn’t seem likely the three will change any time soon.

Since attending the event, we have seen an interest rate cut, which was the first cut since November 2020. However, the issue with inflation remains.

As covered last year, the massive population growth that occurred in the 2023-2024 financial years drove aggregate demand, which kept pushing inflation, and subsequently drove up the CPI rate.

The charts below show the extent of the population growth during this period:

As of 30 June 2024, Australia’s population grew by 106,400 people due to natural increase (births minus deaths), marking a 3.4% rise (3,500 more people) compared to the previous year.

Net overseas migration for the same period was 445,600 people, reflecting a 16.8% decrease (89,900 fewer people) from the previous year. Despite this decline, the total net migration over the past two years remains close to one million people.

Regarding property growth in SEQ, the graph below highlights the suburbs that experienced the highest population influx.

Queensland Property Outlook

From a residential property perspective, price growth is expected to continue into 2025 and 2026. House prices are projected to rise by 5.1% by December 2025, followed by a 4.2% increase in 2026. Unit prices are also forecasted to grow, increasing from 5% in 2025 to 6.1% in 2026.

Compared to other major cities, Brisbane’s property market is expected to outperform Sydney and Melbourne, with stronger growth projections over the next two years.

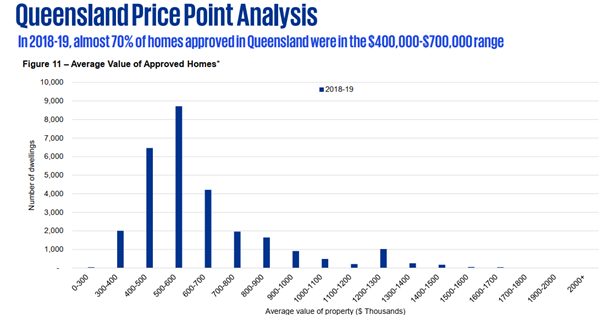

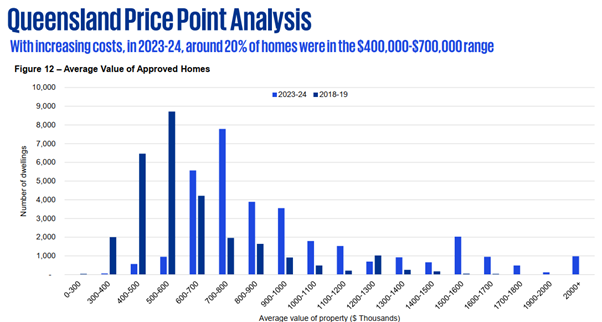

Despite strong demand for housing, dwelling approvals in 2023 were at levels last seen in 2019, highlighting the challenges developers face in making projects financially viable.

While approvals increased slightly in 2024, the rate of new housing construction remains insufficient to meet the net migration demand in SEQ.

Key market trends:

- Brisbane – 5,000 dwelling approvals over the last two quarters of 2024.

- Gold Coast – Showed slight improvement.

- Sunshine Coast – Remained flat.

It’s important to note that not all approvals result in completed homes, further limiting the supply available to meet demand.

This ongoing housing supply shortage has become the elephant in the room for many SEQ residents, as demand continues to outpace new development.

The graphs below illustrate the movement in Queensland home values from the 2019 financial year to 2024, highlighting the impact of these supply constraints.

The commercial property sector continues to see mixed performance.

- Retail property remains under pressure, with high vacancy rates persisting post-COVID. However, industry sentiment suggests the sector may have bottomed out, with some optimism for recovery.

- Brisbane’s office market remains resilient, with vacancy rates lower than both Sydney and Melbourne.

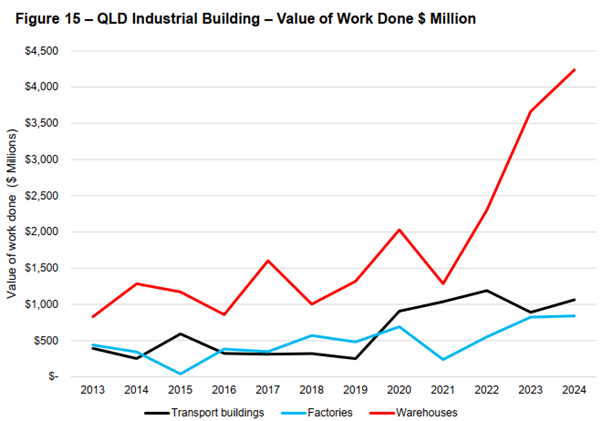

- Industrial real estate continues to boom, maintaining vacancy rates around 1% since 2021, reflecting strong demand.

The graph below highlights investment trends in the industrial sector since 2013.

A portion of the presentation featured a roundtable discussion with property industry experts and developers. Among the panellists was Warren Ebert, CEO of Sentinel Property, a leading property investment firm in Australia.

Key takeaways from the discussion included:

- Northern Territory – Population growth remains strong, and Sentinel’s investments in the region are well-positioned.

- Melbourne – The city continues to experience significant population decline, impacting its property market.

- Retail Market – The sector appears to have bottomed out, presenting new buying opportunities, reinforcing the “buy low, sell high” strategy.

- Productivity & Construction Costs – A heated debate emerged around unions and government policies, with concerns that their influence has driven up construction costs. The consensus was that reform is needed to make development more affordable.

Key Risks and Opportunities in 2025

Current threats to be aware of:

- Productivity Challenges – A global issue with productivity is also affecting SEQ, with union sites averaging only 3.2 productive days per 5-day work week, adding to project delays and costs.

- Infrastructure Delays – The government’s late start on major infrastructure projects, including Olympic developments and large-scale government initiatives, is raising concerns about labour shortages, which are expected to worsen across SEQ.

Current Opportunities in 2025:

- Developer & Construction Collaboration – Partnerships between developers and construction firms are helping more projects move forward by reducing risks and improving feasibility.

- High-Value & Luxury Market Resilience – The luxury property market, including high-end homes and apartments, continues to perform strongly and is expected to remain robust throughout 2025.

Navigating the 2025 Market with Confidence

With ongoing market shifts, risks, and opportunities, having the right financial strategy is key. Whether you’re a property investor, developer, or business owner, Walshs can help you navigate the economic landscape with expert tax, accounting, and financial planning advice.

Contact our team today on 07 3221 5677 or book a meeting here, to ensure your financial strategy is aligned with the latest market trends.

Article by: Tim Reece, Walshs Associate