Ensuring business success requires careful planning, strategic thinking, and effective execution. Here are some key tips that can help you increase your chances of success: Top tips: Develop a clear business plan: A comprehensive business plan outlines your goals, target market, marketing strategy, financial projections, and other key aspects of your business. Understand your market:

As a doctor, you have invested a lot of time and money in your education and training, and you want to make sure that your hard-earned income is well-managed. Real estate investing is one avenue that many doctors are increasingly turning to in order to grow their wealth and create passive income. But why should

From home renos to humble new abodes, unlocking equity opens the door to a wealth of opportunities. If you’re a homeowner, continue reading to learn more about equity – and how you can access it to supercharge your financial status. The lowdown on equity According to Walshs mortgage broker Karen Holmes, equity is the difference

New legislation allows exemptions from paying Fringe benefits tax (FBT) on private use of electric vehicles which meet certain conditions. This article will help you make an informed decision on your next vehicle purchase, exploring the pros and cons and providing any necessary information. What is accepted…and the conditions: The first barrier to the exemption,

If you are an employer, then you will no doubt be aware of Single Touch Payroll (STP) and your obligations to be compliant to the STP2 changes that all employers must complete before 31st March 2023. The Government announced in the 2019-20 Budget, that Single Touch Payroll (STP) would be expanded to include additional information.

The Australian Taxation Office (ATO) has recently revised the fixed rate method for claiming working from home deductions. Previously, the fixed rate was 52 cents per hour and covered only running expenses for home office use. However, the new rate has been increased to 67 cents per hour and now includes additional expenses such as

An economic outlook was presented by the Chief Economist for KPMG Australia – Dr Brendan Rynne at The Urban Developer’s ‘Queensland Property & Economic Outlook’ event recently. He is in the 20% of Australian economists that believes there will be no recession in the technical terms (two consecutive quarters of negative growth in real GDP),

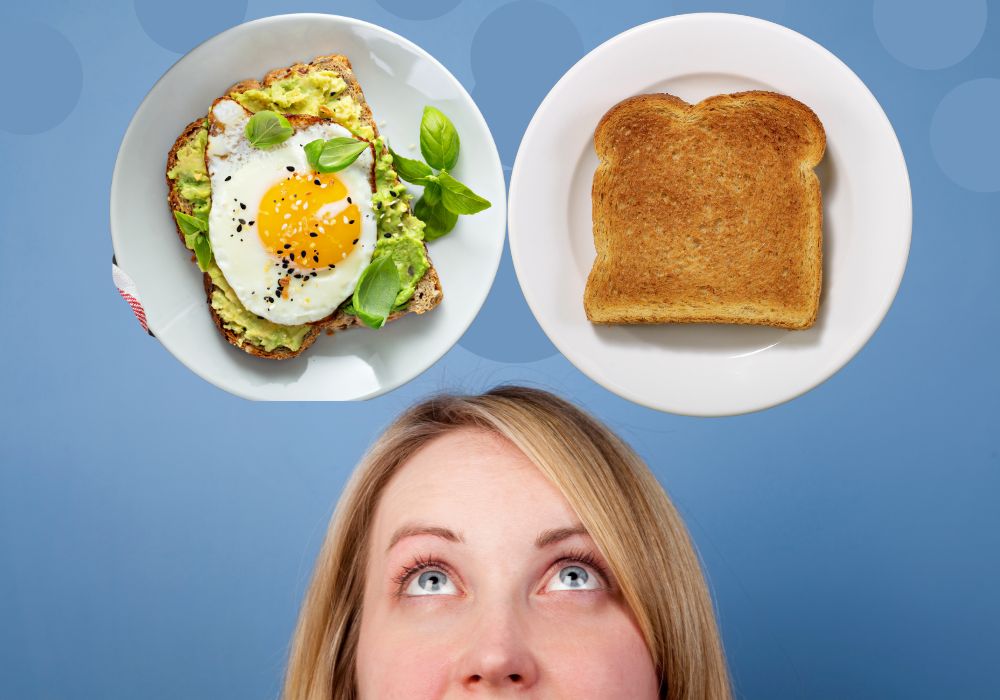

HAVE YOUR AVO AND EAT IT TOO! Saving for a house deposit is the ultimate fun sponge, with many Australians sacrificing years of smashed avo to scrimp and save that hefty 20% deposit. But as a doctor, did you know Walshs has exclusive arrangements with banks to offer speciality deals for medical professionals, including 5%

As leading accountants for healthcare professionals our decades of experience mean we deeply understand the high demands on your time and finances. Our goal is to ensure that you have the financial support and guidance you need to succeed, and we provide specialised accounting and financial adviser services tailored to meet the unique needs of