Dollar cost averaging (DCA) is a popular investment strategy amongst financial planners and investors alike that involves buying a fixed dollar amount of a particular investment at regular intervals over a period of time. The goal of this approach is to reduce the impact of short-term market fluctuations on your investment portfolio.

DCA is a useful technique for investors who are looking to invest in the stock market or other volatile investments but are worried about the risks associated with timing the market. By investing a fixed amount of money at regular intervals, you can avoid making large investments at market highs and potentially losing money when the market takes a downturn.

Here’s an example of how DCA works in practice. Let’s say you have $10,000 that you want to invest in the stock market. Rather than investing the entire amount at once, you decide to use a DCA approach and invest $1,000 per month over the course of ten months.

In the first month, you invest $1,000 and purchase shares of a stock that is currently trading at $50 per share. You are able to buy 20 shares. In the second month, the same stock has increased in price to $60 per share. You are only able to buy 16.67 shares with your $1,000. However, in the third month, the price of the stock drops back down to $50 per share, allowing you to purchase 20 shares again. This pattern continues over the ten months, with the price of the stock fluctuating up and down, but you always purchase the same dollar amount of shares.

The benefit of this approach is that you end up buying more shares when the price is low and fewer shares when the price is high. This means that your average cost per share over the ten months is lower than if you had invested the entire $10,000 at once. Additionally, because you are investing regularly, you are able to take advantage of the power of compound interest.

Throughout history, some of the greatest investment opportunities are presented in times of heightened market volatility and stock market weakness. Our managed fund savings plans are designed for clients to continuously invest their surplus cash into, accumulating units in a suite of funds that we believe offer the best long-term returns.

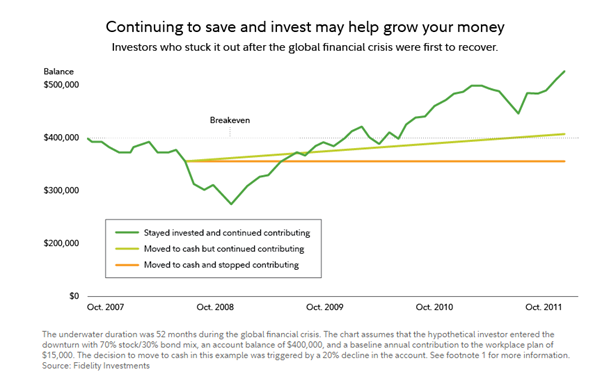

It has always been the Walshs philosophy to invest into financial markets through all cycles – up or down. Whilst it is never easy to continuously deploy your hard-earned money into investments which seemingly only decrease in value, there is empirical evidence to support this method of investing, as seen in this chart which shows the benefit of DCA throughout the GFC.

As the chart suggests, being fearful may not be the best mindset for long term wealth creation. There is an age-old adage that financial minds love to quote: Time in the market is more important than timing the market. The Walshs investment strategy for these savings plans is to combine the two lines of thinking; buy through market cycles to avoid timing your market entry, and to be consistent in doing so.

There are some potential downsides to DCA, however. For one, you may miss out on market gains if the market goes up consistently during the time period that you are investing. Additionally, because you are investing over a period of time, you may end up paying more in transaction fees than if you had invested a lump sum at once.

Overall, dollar cost averaging is a useful investment strategy for those who are looking to invest in the stock market or other volatile investments. By investing a fixed amount of money at regular intervals, you can reduce the impact of short-term market fluctuations on your investment portfolio and potentially lower your average cost per share over time.

To find out more about how we can help you with your investments, please send us an email or call 07 3221 5677.

By: Tim McAllister, Investment Analyst | Walshs