Selling your rental property is a great opportunity to unlock some personal equity. But don’t forget the taxman wants a slice of the cake. Capital gains tax (CGT) is liable for the profits on the sale of property, however the capital gains tax 6 year rule provides some exemptions which can be utilised to optimise your tax position.

The Main Residence Exemption – AKA the Capital Gains Tax 6 Year Rule

The main residence exemption (MRE) is the most commonly used exemption from capital gains tax (CGT). It allows homeowners to sell their property without incurring CGT if it has been their main residence. This exemption extends for up to six years after moving out if specific criteria are met and is often called the ‘capital gains tax 6 year rule’.

During this period, if you don’t establish a new main residence (i.e. you stay in rented or short-term housing while you are away), you will qualify for the MRE. Furthermore, you can even earn rental income from your main residence and still qualify for the MRE.

Eligibility for the capital gains tax 6 year rule

In order to be eligible for the CGT exemption;

- Your property must have been your main residence first. You cannot apply the main residence exemption to a period before a property first becomes your main residence (e.g. if you rented out your home before you lived in it).

- You must have stopped living in the property.

- You must be an Australian resident at the time of sale. Foreign residents are not entitled to MRE.

You can elect for the MRE in your income tax return for the financial year in which the sale contract date falls. Additionally, if your main residence was being used to produce income, it is up to your discretion as towhen the MRE applies – up to the maximum 6-year limit.

The ATO created the capital gains tax 6 year rule to recognise the many circumstances under which you may not live in your property for some time. The rule will appeal to any homeowners who are thinking of making some additional income when unable to reside in their own home.

The following examples highlight various scenarios where the ‘capital gains tax 6 year rule’ can apply:

Scenario 1: A new main residence is established

Josh is earning rental income from his main residence in Brisbane for 4 years while he works and rents a property in Sydney. In 2020 Josh decides to purchase a property in Sydney, establishing a new main residence. Two years later , in 2022, Josh sells his Brisbane property.

Josh can claim the capital gains tax 6 year rule on his property for any gain in property value up until 2020. He will then only be liable for CGT on the change in property value from 2020 to 2022.

*Note: in this scenario it is crucial that Josh obtains a property valuation of his Brisbane property on the 2020 date that he moves out of his home.

Scenario 2: A period of absence from a main residence

For four years Josh earns rental income from his main residence in Brisbane while residing in a rented property in Sydney. Later, Josh returns to his Brisbane property, with no changes to his main residence. As Josh moves back to his Brisbane property, the six-year exemption for the MRE resets.

Scenario 3: Use of MRE

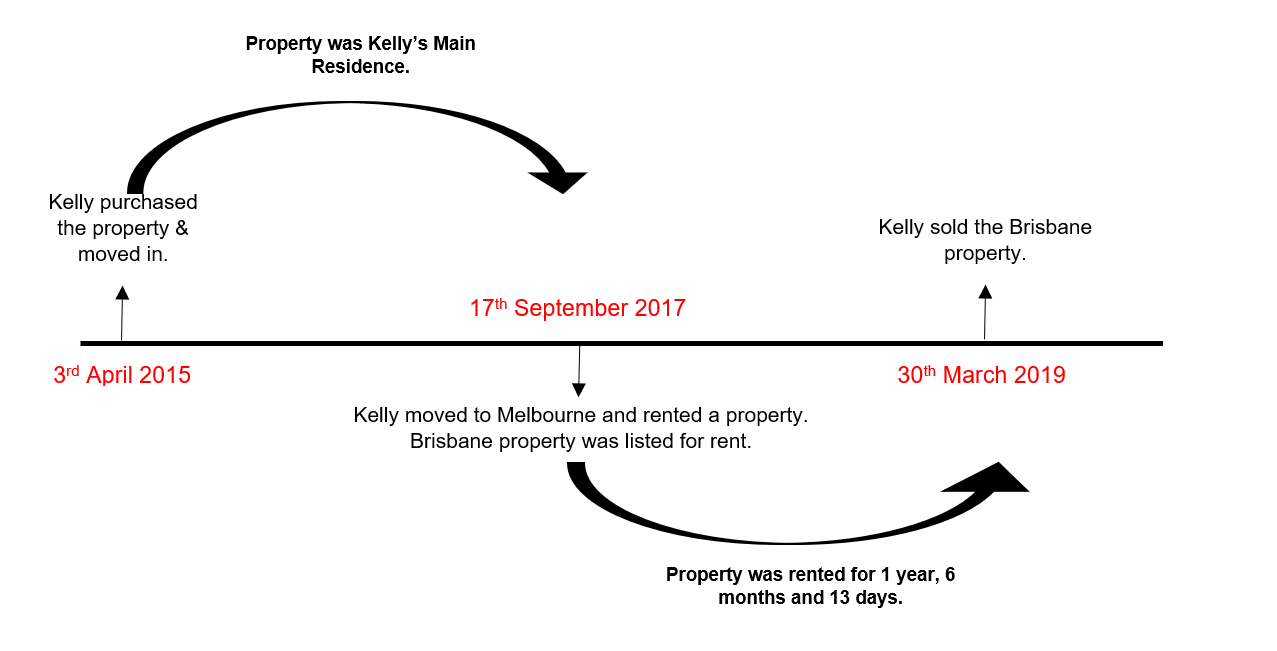

Kelly purchased an apartment in Brisbane on 3 April 2015, and moved into the property immediately. In September 2017, Kelly moved to Melbourne where she rented a property in St Kilda. At this time, Kelly listed her Brisbane property for rent. The Brisbane property was rented for two years. Kelly decided to sell the property on 30 March 2019. Kelly is entitled to the capital gains tax 6 year rule (or MRE) as she was only renting the property in St Kilda, and had lived in her Brisbane property after purchasing it.

If the above information is something you would like to explore further, we encourage you to contact us on 07 3221 5677 or email enquiries@walshs.com.au. You can also schedule a meeting with us by clicking on this booking link.

By: Rachel McGrath, Accountant | Walshs