We launched the new Walshs App just last month and now we have made our first update, with a state-of-the-art GPS Logbook, using advanced GPS technology to accurately track both your business and personal trips.

We’ve added this enhancement so you can use the GPS Logbook within our App to help prepare for your tax returns, and track daily journeys, in the easiest possible way.

Background auto tracking – no missed journeys!

With advanced GPS capability and auto tracking, as soon as you open the GPS Logbook, it will initiate a background tracker that will trigger the GPS to start recording as soon as you are driving, increasing the number of journeys accurately tracked, and ensuring a smooth, hassle-free way to log all of your kilometres in one place.

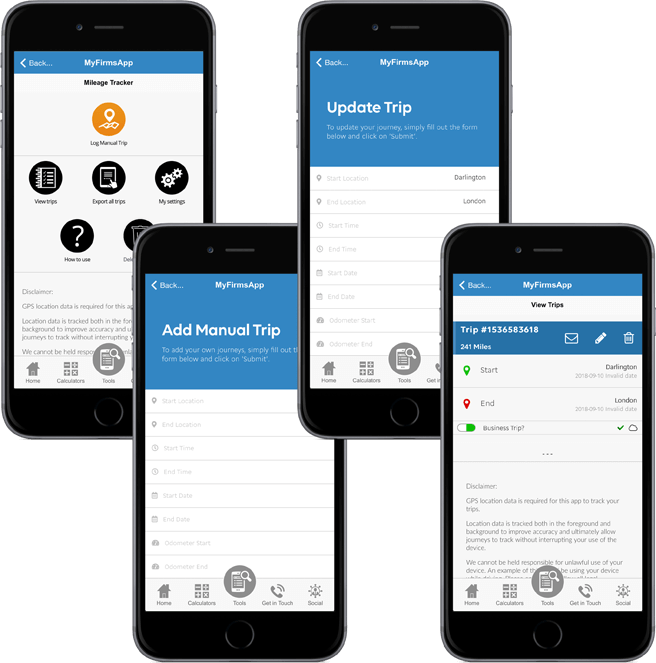

Log and edit Manual trips

Even in manual mode, the GPS Logbook is simple to operate; you can fill out a manual form entry to log the details of a trip for the App and categorise as either personal or business. This will also sync to the cloud in real-time, meaning your trips are backed up and stored safely.

You can view a list of all the trips you have made, including start and end locations, dates, times and kilometres covered. You can then edit the trip in-App, and toggle between business or personal classification, and then export directly to us.

Upgrade to the new GPS Logbook now!

We hope you are excited for this update as much as we are – you just need to update the App if you haven’t already and the GPS Logbook will be ready-to-use.

We are always looking for ways to offer the best service to clients using high-tech technology to make life easier for you when it comes to preparing for your end of year tax returns.

Don’t have our App?

Our App is free to download from both Apple and Android stores, and you can also access essential day-to-day tools in-App to help with your finances, including tax calculators, currency converter, checklists and more!

If you haven’t downloaded our free App, please head to the Apple or Android store on your device and search for MyApp and enter the code WALSHS2018. MORE HERE

As this advice is general in nature please do not hesitate to contact one of our adviser accountants or financial planning advisers if you have a query that is specific to your circumstances.